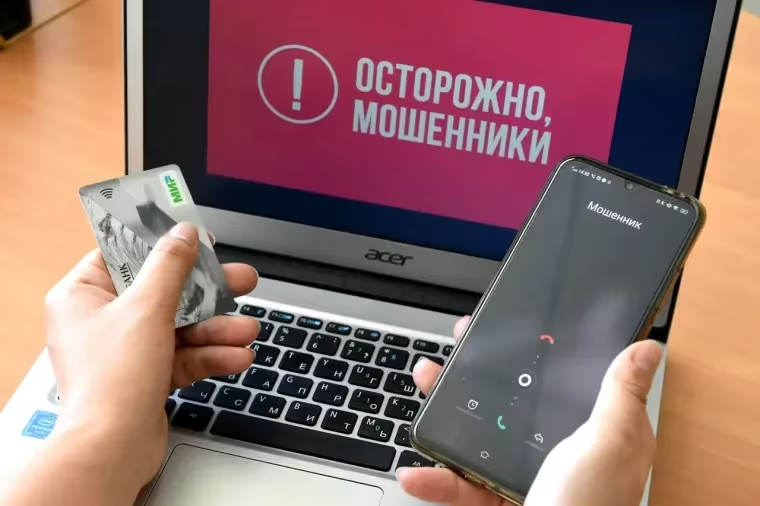

Russian specialists have created a neural network that warns of fraud 2 hours before a transaction

VimpelCom, which operates under the Beeline brand, said it has developed an innovative AI model designed to identify sophisticated psychological tactics that are increasingly being used by criminals to defraud Russian citizens and steal their financial assets.

Russian experts have created a neural network that warns of fraudulent transactions one hour before they occur.

As part of the new fraud protection system, the Beeline team has made fundamental changes to the existing analysis methods on the market by creating and implementing a fundamentally new algorithm. This algorithm is capable of detecting signs of potential fraudsters’ influence on bank customers and users of various services, both in the medium term (2-3 hours) and in the long term (from 24 hours to five days).

“Most social engineering cases have a duration of 6 hours to 2 days. But there are scenarios where the fraudsters first verify that the “victim” has money or valuables in the bank, rather than in direct access. Then they play out a play with a longer warm-up time (usually from a day to three days). Almost all such events fall within the time window of 5 days, so the Bilayn development team focused on this particular time period.”

Specialists have identified eight key signs, which in a certain combination with a high degree of probability indicate that a person is under the prolonged influence of fraudulent schemes. The algorithm analyzes the user’s recent actions and compares them with his or her usual behavior over a longer period. If significant deviations are detected, such as an increase in the number of contacts with strangers or a change in the usual communication style, the system captures these changes for further investigation.

When a bank receives a request for a questionable transaction, it has the option to refer to information provided by the service provider. If the system detects signs of prolonged exposure, this serves as a signal to the bank’s risk assessment or security department: the transaction should be suspended and the customer should be warned and protected from loss of funds. Event assessment information shall be transmitted to the bank only if the user consents to the processing and transmission of data for the protection of his/her rights and legitimate interests, including the prevention of fraudulent actions.

“The updated anti-fraud system with the new algorithm has already proved its effectiveness and has been tested for six months in seven large Russian banks. Modeling on anonymized retrodata of 4 million customers showed that the accuracy of event detection was about 92%. The algorithm identified about 20 thousand virtual cases with “fraudsters”, and in 18 thousand cases it was able to warn about their actions in advance. With the help of the new algorithm, the bank receives a signal of anomalies 2-3 hours before the client tries to transfer money.

The Russian experts have created a neural network that warns of fraud 2 hours before a transaction was first published on ITZine.ru.