Trump temporarily halted duty implementation – Tesla and Nvidia shares surge

The stock market rebounded rapidly after Donald Trump’s sudden announcement of a 90-day suspension of reciprocal tariffs. This provided a strong impetus for the recovery of tech giants and the crypto market, which suffered last week after the announcement of the new duties.

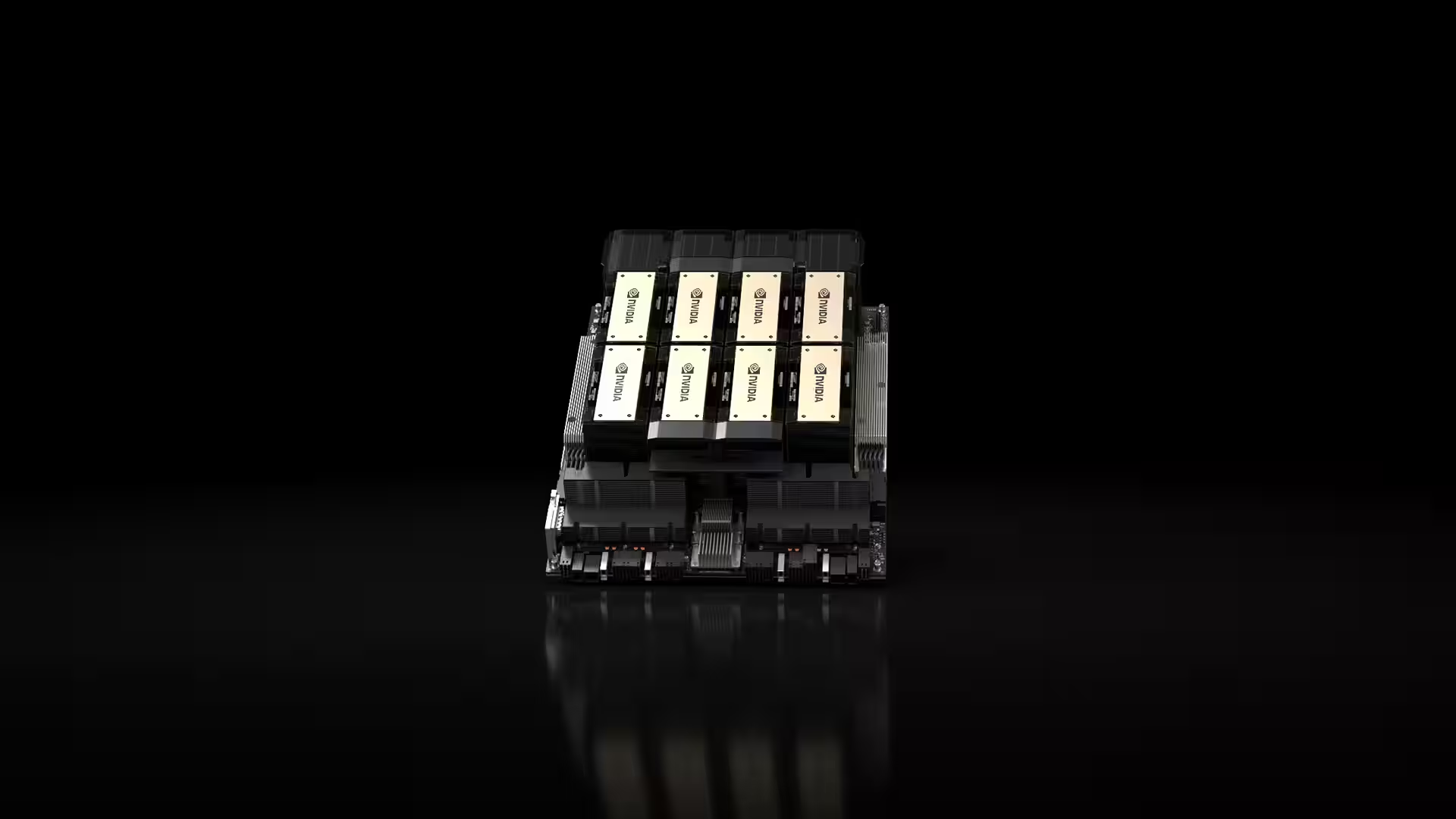

Now that the flames ignited by Trump himself have been temporarily doused, stocks of major companies are heading back up – Tesla, Nvidia, Intel and other IT sector heavyweights in particular have stood out.

The market went up after the blowback

Trump made the announcement of the temporary rate freeze via his social media network Truth Social. He announced a rate cut to 10% and indicated that the pause only applies to countries in active negotiations with the US. For example, South Korea and Vietnam can count on a reprieve, while for China the duties not only remain, but also intensify – a new tariff of 125% is being imposed.

Despite these conflicting policies, even the partial easing of the measures has sparked a wave of optimism on Wall Street. Shares in Apple, Sony and Microsoft jumped instantly. Tesla rose almost 23% in a day, Nvidia by 15% and Intel by more than 17%. Meta*, Amazon and Alphabet also rose.

Cryptocurrencies also rebounded

The news of the easing of trade measures was quickly reflected in the crypto market as well. Bitcoin, which has fluctuated between $70,000 and $79,000 in recent days, broke the $82,000 mark again. Ethereum added 8% in just a few hours after Trump’s announcement.

This was a sharp turnaround after a troubling weekend that saw analysts discussing a possible “Black Monday.” At the time, rumors of an impending tariff pause spread on social media X, which the White House officially denied. Now, however, it’s clear: Trump has indeed decided to ease the pressure – albeit temporarily.

The trade war continues

Worth noting: despite localized improvements, trade tensions between the U.S. and China are far from over. The 10% global duty remains in place, and tougher conditions for Chinese goods could trigger a new wave of retaliatory measures. This makes the future of global markets highly uncertain.

Nevertheless, even the short-term stability has allowed major companies to partially recoup losses. This is especially important for Apple, which last week suffered its worst four-day drawdown since 2000. For now, investors are cautiously happy – but the volatility hasn’t gone away.

* Owned by Meta, it is recognized as an extremist organization in Russia and its activities are banned.