Canalys: The global smartphone market remained flat in the first quarter

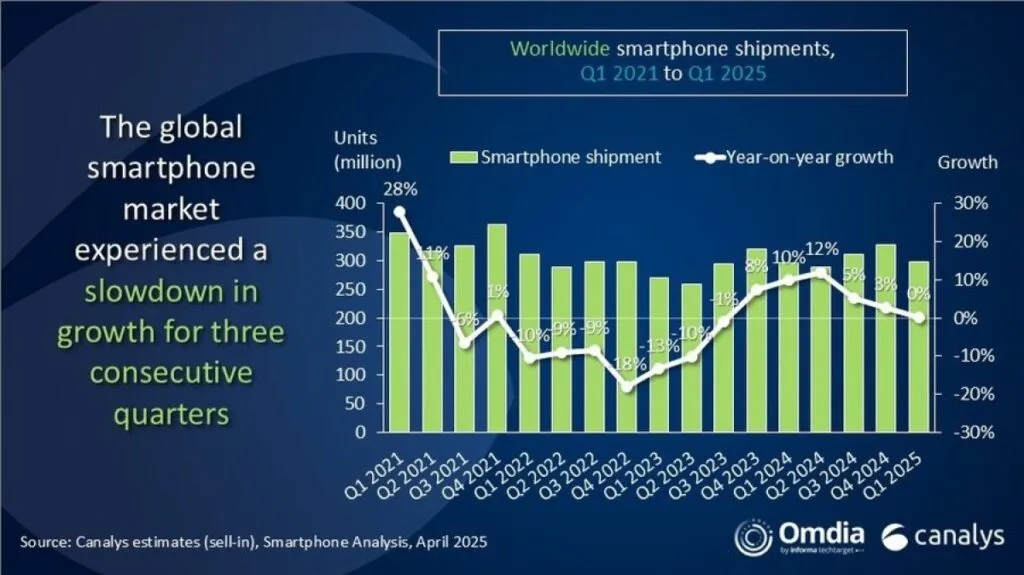

Analytics firm Canalys has released a fresh report on global smartphone shipments for the first quarter of 2025. Growth was just 0.2% year-on-year, with total shipments reaching 296.9 million units. While some key markets saw an uptick, the overall growth was very modest.

Smartphone shipments in the first quarter of 2025 were up just 0.2% year-on-year.

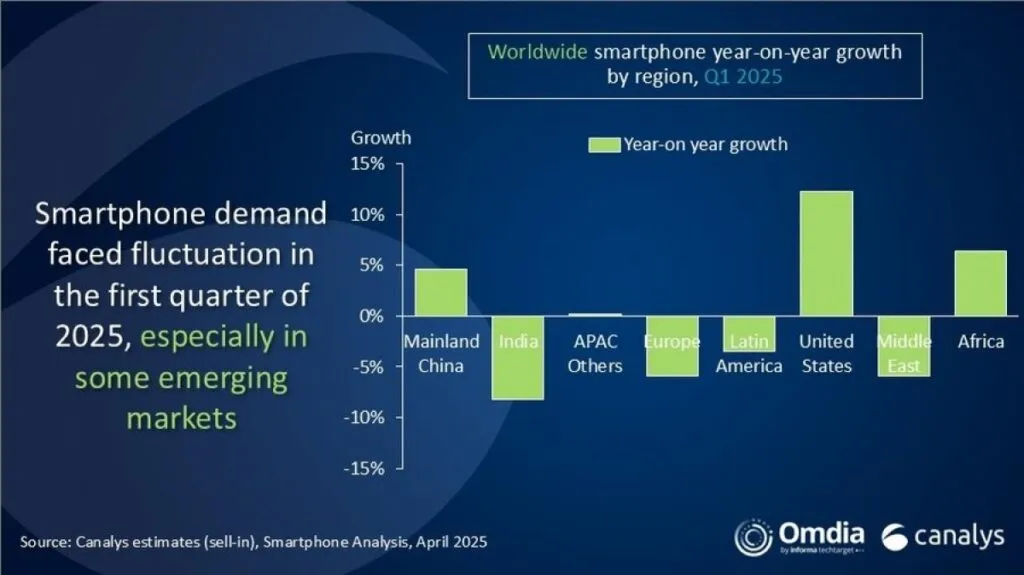

Growth in the U.S. and China, declines in India and Europe

Positive momentum was recorded in mainland China and the US, where demand for smartphones continues to grow. However, it was offset by declines in India, Europe and the Middle East, where consumers are cautious. The decline was particularly pronounced in markets with historically strong device replacement, such as Latin America and the Middle East, as users became less likely to upgrade their smartphones.

Europe prepares for new EU requirements

In Europe, the market is facing high inventory levels. This is due to strong shipments as early as 2024 – manufacturers have been keen to prepare in advance for the EU directives coming into force at the end of 2025. The new rules will require manufacturers to produce more repairable devices with enhanced support for upgrades.

Africa and the US: growth and tension

The African market has seen high retailer activity and aggressive brand expansion. Companies like vivo and Honor have seen double-digit growth, with Honor hitting an all-time record for sales outside of China. In contrast, active shipments in the U.S. were driven by attempts to circumvent the duties associated with “Emancipation Day.” While this helped temporarily boost volumes, the budget segment will take a hit, raising the average price of devices and creating difficulties for consumers and manufacturers.

Brand Layout

- Samsung retained its leadership with a 20% market share

- Apple follows closely with 19%, thanks in large part to inventory build-up in March

- Xiaomi holds steady in third place with 14%

- vivo and Oppo round out the top five

Predictions and Challenges

Despite moderate results, major brands remain optimistic about the second quarter. Lower inventories and new model launches should revitalize the market. However, competition is getting fiercer in the mid-price segment ($200-$400). Increasing global trade conflicts and a shift to localized production, which will require new investments and increase costs, could add to future tensions.

The Canalys: Global smartphone market flat in Q1 was first published on ITZine.ru.