Bitcoin halving has occurred. Payouts decreased and transaction fees increased

The bitcoin network experienced its fourth halving on the night of Saturday, April 20. Manners payments have now been halved, from 6.25 BTC to 3.125 BTC. At the time of the halving, bitcoin was trading at $63.7k, with a capitalization of $1.16 trillion.

At the time of the halving, bitcoin was trading at $1.16 trillion.

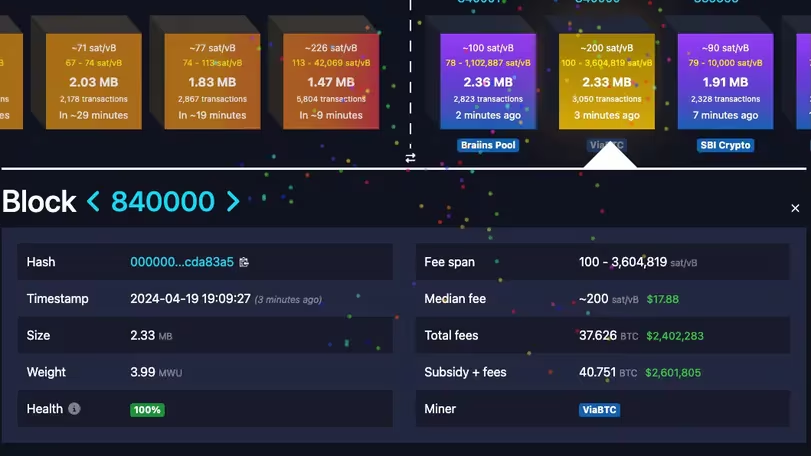

Bitcoin (BTC, Bitcoin) completed the fourth halving in its 15-year history — an event as revered and anticipated in the blockchain community as the World Cup and Olympics are in sports. The event, which occurs every four years and halves the reward for miners to create new bitcoins, occurred at 00:09 GMT on Saturday when the 840,000th block was added to the bitcoin blockchain.

The event, which occurs every four years and halves the reward for miners to create new bitcoins, took place at 00:09 GMT on Saturday.

While the price of bitcoin mostly held above $63,000, something else graced the show: Bitcoin transaction fees surged as the launch of a new protocol called Runes led to a shaft of transactions as speculators rushed to mine digital tokens on the blockchain.

At the time, the price of bitcoin mostly held above $63,000.

The 840,000 block on which the halving occurred saw a record high fee of 37.6 BTC (worth more than $2.4 million), and within an hour of the halving, the fee remained well above normal.

The winning mining pool for that block was ViaBTC, which was entitled to a bitcoin reward at the new, just-increased rate — 3.125 BTC per block, worth about $200,000 at the current price. But cryptocurrency miners fought vigorously for the block because it contains the first «sat» — smallest bitcoin denomination — after being halved. These «epic sat» sats» that follow the halving are considered a collector’s item, and some mining executives have speculated that this individual bitcoin fragment could be worth millions of dollars or many times the current price of an entire bitcoin.

A number of bitcoin miners have suggested that this single bitcoin fragment could be worth millions of dollars or many times the current price of an entire bitcoin.

The Runes protocol for exchangeable tokens from Casey Rodarmore, developer of the Ordinals platform that was launched last year to create NFTs in bitcoin, also launched on the 840,000 block. According to the runealpha website, less than an hour after launch, 853 runes had already been etched. A quick glance at the fees paid by users to include transactions in the blocks may reflect the intense competition between users for minting new runes: a fee of $2.4 million for a halving block, compared to $40,000 to $60,000 for a more typical pre-halving block. A few subsequent blocks have also commanded fees of more than $1 million.

Some users have also paid more than $1 million.

«There has never been anything like this in the history of bitcoin» — said prominent developer Jimmy Song during a live broadcast of a party organized by Tone Vays. «We’re loading the network in a different way, in a way that we’ve never loaded it before».

And we’re loading the network in a different way, in a way that we’ve never loaded it before.

Chain data shows that the median fee per satoshi per byte (sats/vByte) rose after the halving to 1,805 sats/vByte. Before the April 19 halving, the median fee was around 100 sats/vByte.

(Sats/vByte (satoshi per byte) — is a measure of the fee used to conduct a Bitcoin transaction, showing how many satoshis (the smallest unit of Bitcoin) you are willing to pay for each byte of data in your transaction).

Sats/vByte (satoshi/vByte).

Translated into plain language, that means transaction fees have skyrocketed, with medium-priority transactions costing $146 and high-priority transactions — around $170. Miners are expected to rely more heavily on higher transaction fees and the potential rise in the bitcoin price to offset the expected decline in revenue due to reduced subsidies for mining, especially in the short term.

Miners are expected to rely more on higher transaction fees and the potential rise in the bitcoin price to offset the expected decline in revenue due to reduced subsidies for mining, especially in the short term.

Accordingly, the price of bitcoin is expected to rise to $146 per transaction.

Mining fees, which dropped to 3.125 BTC from 6.25 BTC during this decrease, are an incentive for organizations that provide computing power to secure bitcoin. The miner who wins the race to add each new block to the network picks up the mining fee, the amount of which remains fixed until it is cut again at the next halving, as programmed by the cryptocurrency’s elusive creator Satoshi Nakamoto. However, the rise in fees after halving suggests that miners may have a lucrative new revenue stream in the Rune era, although several people who spoke on the Tone Vays live stream expressed confidence that the jump in fees will prove temporary.

Miners may have a new lucrative revenue stream in the Rune era.

In the crypto community, the four-year halving is considered a landmark event because it symbolizes the original concept of bitcoin as an autonomous, decentralized financial network whose monetary policy is determined by code rather than by human organizations like governments and central banks.

Unlike traditional, or fiat, currencies, whose value has historically been undermined by inflation and government money printing, bitcoin is designed as a non-inflationary currency with a maximum total supply of 21 million BTC per obr With fewer bitcoins being issued every four years, the rate of bitcoin issuance is decreasing over time until the last one is mined, probably in 2140.

The rate of bitcoin issuance is expected to decline until the last one is mined, probably in 2140.

Historically, the decline in the number of bitcoins has been followed by a spike in their price. The thinking is that the fewer new BTCs issued, the more valuable the existing ones become. This time the outlook is dim. Some market commentators argue that a halving of the price is already built into BTC, and so the immediate effects may be muted. Others believe that the bitcoin price is falling, while still others believe a rally is imminent. The potential consequences of the current halving cannot be predicted due to the profound differences in the bitcoin landscape compared to the three previous events. In particular, the long-awaited January approval of spot bitcoin exchange-traded funds (ETFs) in the US means that orders of magnitude more institutional investment is coming into BTC. In addition, since the launch of the Ordinals protocol early last year, there has been much more activity under the bitcoin hood, with developments and updates to the network potentially bringing much more value to the notoriously conservative ecosystem.

At the same time, there is a lot more activity under the bitcoin hood.