Crypto exchange Kraken is preparing for IPO and may raise up to $1 billion in funding

The largest US cryptocurrency exchange Kraken is considering raising up to $1 billion ahead of an initial public offering (IPO) that could take place as early as the first quarter of 2026. This is reported by Bloomberg, citing informed sources.

According to the publication, Kraken is in preliminary talks with Goldman Sachs and JPMorgan Chase about issuing a debt instrument worth between $200 million and $1 billion. The proceeds are expected to be used for business expansion rather than for operating expenses.

Bloomberg has previously repeatedly reported on Kraken’s interest in going public. According to sources, the company’s IPO plans intensified after the presidential election victory of Donald Trump, known for his more favorable stance toward the crypto industry.

The company’s plans for an IPO have intensified since the election.

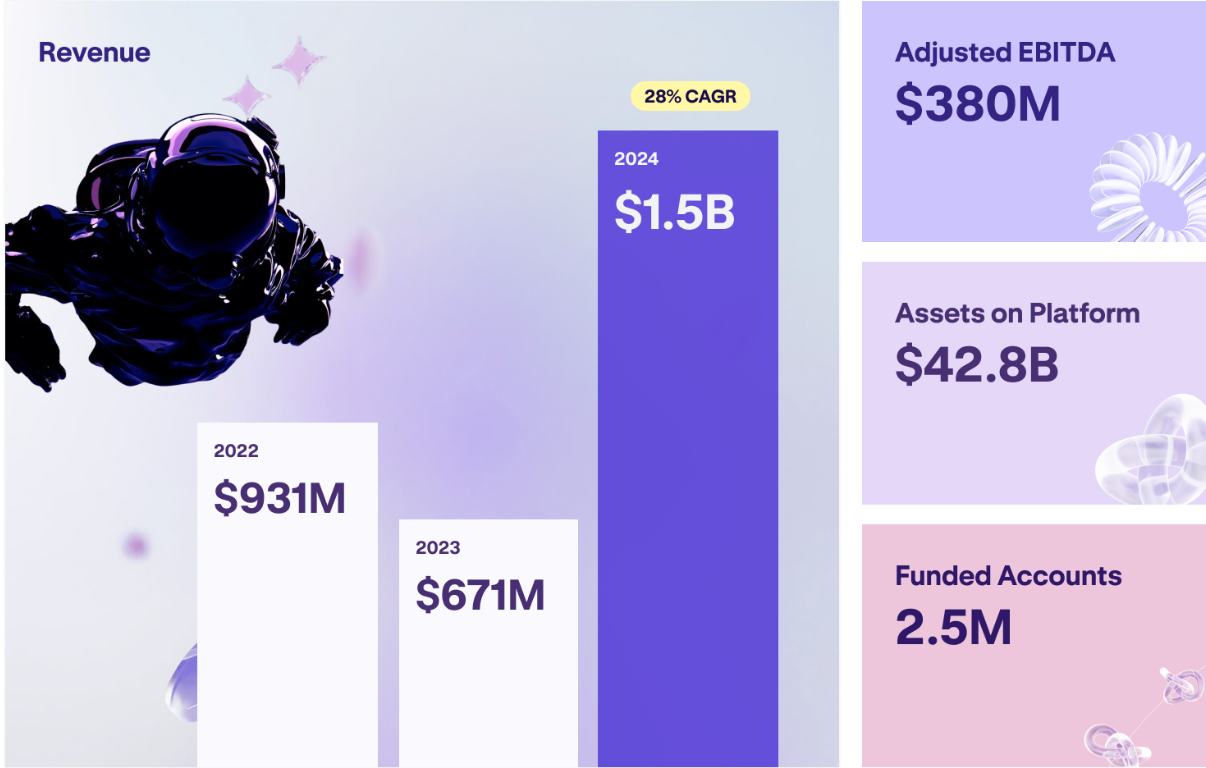

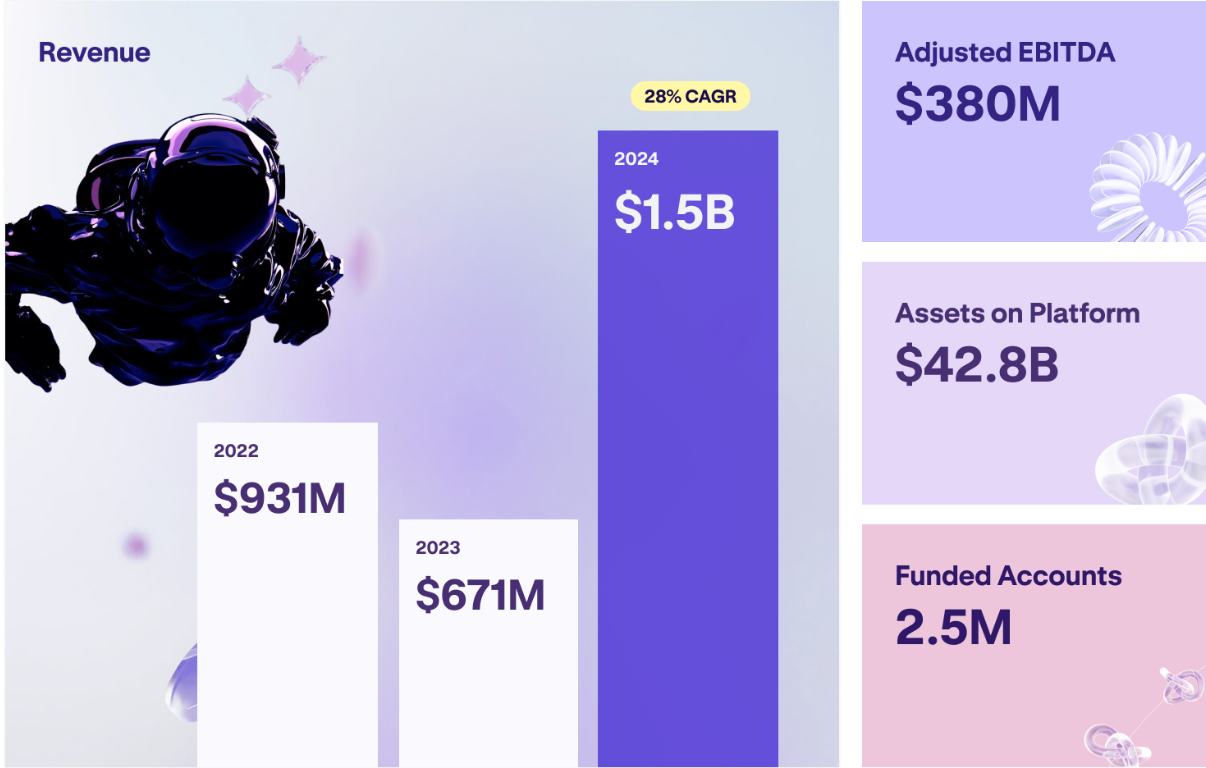

In 2024, Kraken posted impressive results:

- Revenues for the year totaled $1.5 billion, an increase of 128% over 2023.

- Adjusted earnings reached $380 million.

- Total annualized trading volume was $665 billion, according to CoinMarketCap.

.

According to statistics from the last 24 hours, more than $1.1 billion worth of transactions have taken place on the Kraken platform, making it one of the largest exchanges in the world.

NinjaTrader Acquisition and Expansion of Services

Recently, Kraken announced the $1.5 billion acquisition of brokerage NinjaTrader. This platform specializes in futures trading and is registered with the U.S. Commodity Futures Trading Commission (CFTC).

The deal was part of Kraken’s strategy to expand beyond the cryptocurrency segment and develop multi-asset services, including stock trading and payment solutions.

Reemergence of Steaking in the US

After a nearly two-year hiatus, Kraken has resumed stacking services for customers in 37 US states. Users can now earn rewards for participating in steaking 17 cryptocurrencies, including Ethereum and Solana.

This is thanks to more favorable regulation of the crypto market in the United States – Kraken was among the exchanges exempt from pressure from the US Securities and Exchange Commission (SEC).

With rapid growth, improved financial performance and a positive political atmosphere, Kraken is making steady strides toward becoming a public company, and the upcoming funding round only confirms that strategy.