Cryptocasino revenues have surpassed $80 billion – regulators can’t cope

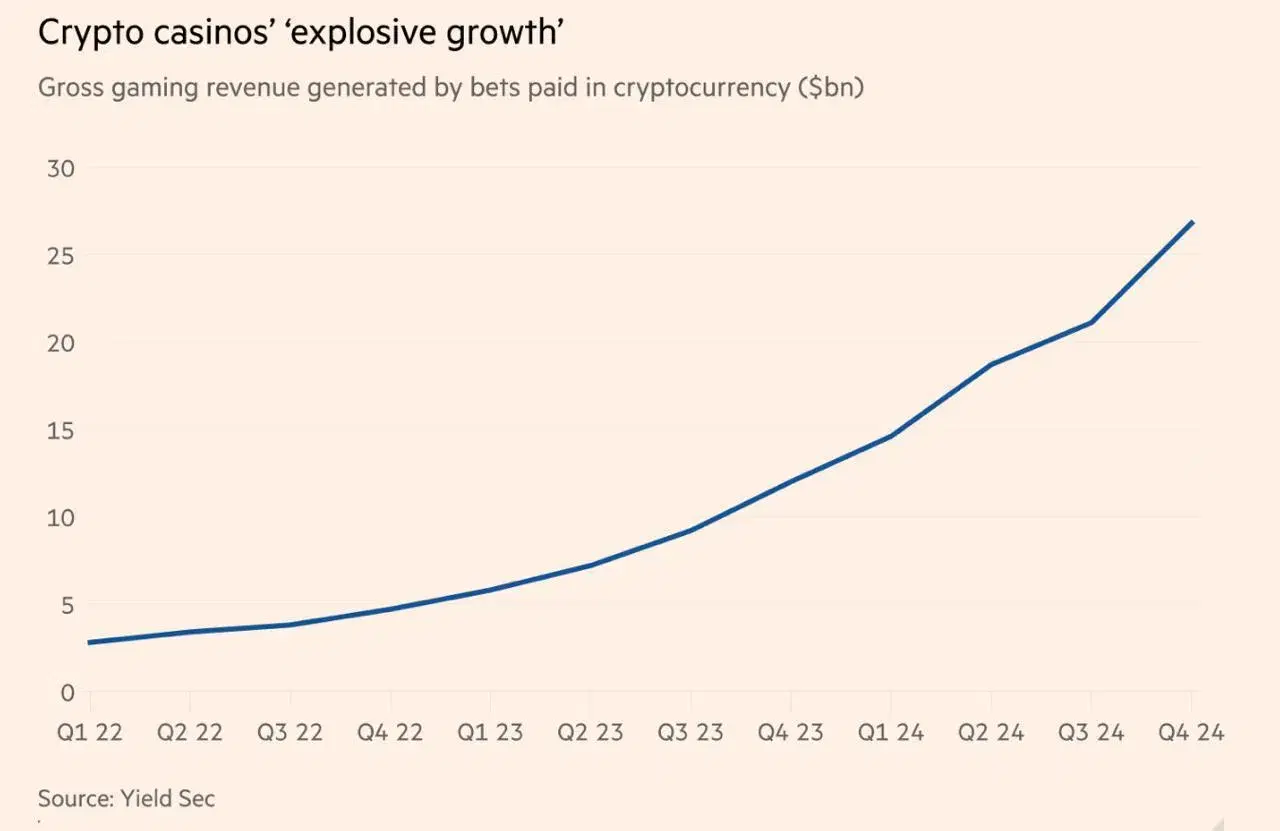

Global cryptocurrency gambling market is showing record growth rates: in 2024, the total revenues of cryptocasinos reached $81.4 billion. This amount is already 10 times higher than the volumes of legal bets accepted by officially licensed operators. Despite stricter legislation, offshore platforms continue to grow their audience, circumventing blockades and borders.

Cryptocasinos remain outlawed in most countries around the world. Online betting using digital assets is banned in the United States, China, European Union countries, the United Kingdom and several other nations. However, users are quickly mastering geo-blocking workarounds using VPNs, proxy servers and anonymous wallets. Moreover, detailed instructions can be found in the public domain, and popular influencers are actively promoting such schemes, receiving a share of the audience’s losses.

Important: According to Russian law, the activity of online casinos, including crypto platforms, is prohibited on the territory of the Russian Federation. Participation in gambling on such resources carries not only financial, but also legal risks. The material is for informational purposes only and is not a call to participate in gambling.

Crypto gambling has only been legalized in a handful of jurisdictions so far – such as Malta, Isle of Man, Gibraltar and Curacao. That’s where the biggest players in the market are registered, including Stake, Rollbit and Roobet.

Stake, for example, is run by Curacao-registered Medium Rare and already processes up to 4% of all transactions on the Bitcoin network. Since launching in 2017, users have placed over 300 billion bets on the platform. Stake’s revenue for last year amounted to $4.7 billion – that’s 80% more than in 2022. However, the company itself denies that it is a cryptocasino: according to their data, more than half of all transactions on the platform take place in conventional currencies.

Offshore operators are rapidly gaining share in traditional markets – primarily those with the most stringent restrictions. The UK, Germany and, starting in 2026, Finland have tightened or are preparing to tighten regulations – including bans on advertising and affiliate programs. This is causing a mass exodus of licensed operators, with crypto platforms filling the niche.

The cryptocasino boom has been made possible by a combination of poor international coordination, the growing popularity of cryptocurrencies, and increasingly sophisticated methods of circumventing regulation. Players are attracted by generous bonuses, simplified registration, no KYC, and the ability to bet anonymously.

Cryptocasinos are also attracting players with generous bonuses, simplified registration, no KYC, and the ability to bet anonymously.

But such freedom comes with high risk. The lack of regulatory protection, the instability of the crypto market and the lack of access to addiction assistance mechanisms make participation in such platforms particularly dangerous – especially for vulnerable groups of players.

Experts believe that the way to solve the problem is through dialogue between government agencies, operators (including cryptocurrencies), affiliates and organizations involved in protecting users’ rights. Education is also needed: players should be clearly aware of the consequences of gambling outside the legal framework.

Today’s bans have not stopped the industry – they have only forced it to change its face and move offshore.