SK Hynix reports record profits thanks to rising demand for AI chips

South Korean company SK Hynix Inc. announced record quarterly profit and revenue amid strong demand for its memory chips used in Nvidia processors for artificial intelligence development. The company recorded an operating profit of 7.03 trillion won (about $5.1 billion) in the third quarter of 2024, beating analysts’ forecasts. The company’s revenue nearly doubled, indicating a significant recovery in the memory market.

The company’s revenue nearly doubled, indicating a significant recovery in the memory market.

Demand growth for DRAM and NAND chips in 2025

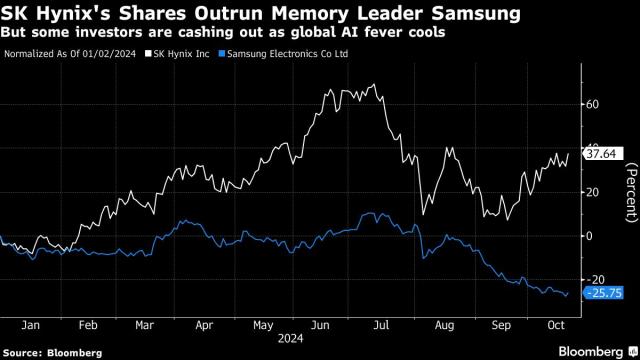

The company also forecasts demand for DRAM and NAND flash memory chips to grow at 15% or higher in 2025, signaling a continued positive trend in the industry. Despite these gains, the company’s shares were down 1% on the Seoul Stock Exchange, although they have already gained more than 35% this year. That’s because SK Hynix has significantly outpaced rivals such as Samsung Electronics Co.and Micron Technology Inc. in producing advanced high-bandwidth memory used in Nvidia’s AI gas pedals.

Samsung Electronics Co.and Micron Technology Inc..

New HBM3E memory tier and revenue impact

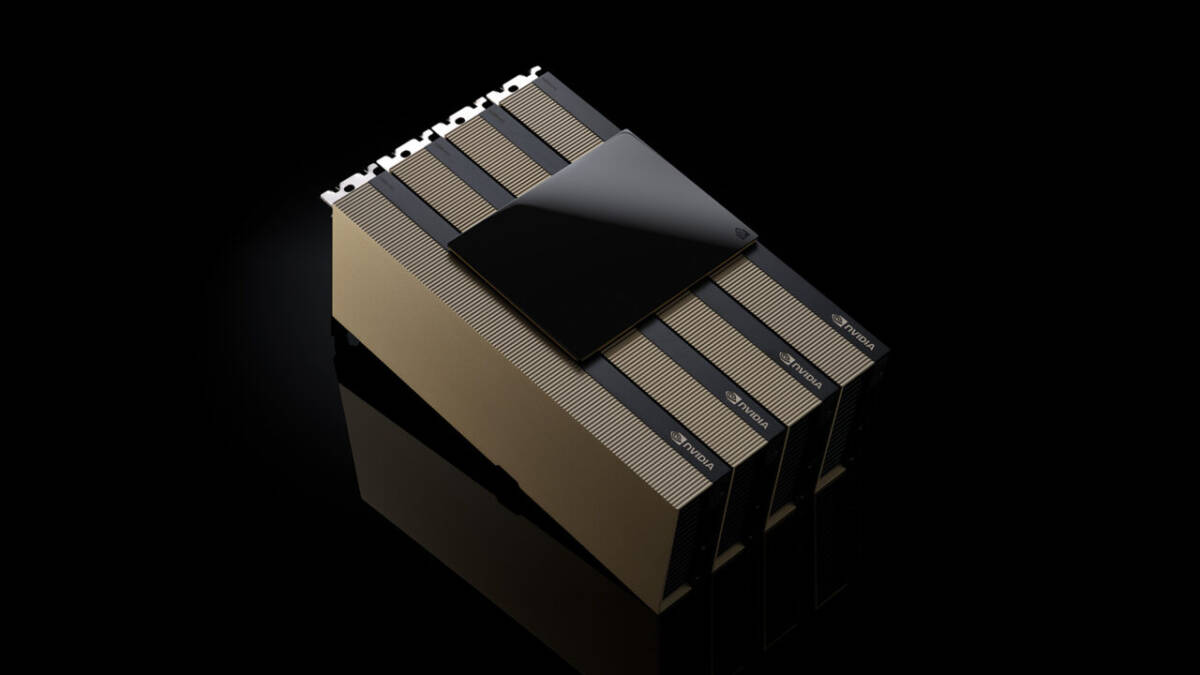

Nvidia recently confirmed plans to start shipping its latest 12-layer HBM3E memory in the fourth quarter of 2024. This should increase the share of HBM memory sales in SK Hynix’s total revenue from 30% to 40%. However, despite advances in artificial intelligence, the company and its competitors continue to face the consequences of a long decline in the PC and smartphone memory sector.

HBM3E.

Hynix’s advantage amid falling prices for legacy chips

.

According to analysts, SK Hynix’s results demonstrate its strategy of focusing on premium products, allowing the company to remain profitable amid falling prices of legacy chips. For example, the average selling price (ASP) of DRAM chips rose 15% over the previous quarter at rival Micron, which may have also helped SK Hynix’s margins.

The company’s results also showed that it has been able to improve its margins.

Rising investment in AI technology

Demand for SSDs for enterprise data centers also had a positive impact on the company’s results. SK Hynix said its capital spending in 2024 is likely to exceed initial plans to keep pace with the boom in spending on AI equipment. Capital expenditure is expected to continue to rise in 2025.

SK Hynix said it will continue to increase its capital expenditure in 2025.