BYD and Tesla lead the fast-growing global electric vehicle market

The global shift to electric traction is accelerating, and competition in the electric vehicle segment is more intense than ever. New data shows that global sales of new energy vehicles (NEVs), which includes electric cars and plug-in hybrids, reached 5.39 million units in the third quarter of this year. This is an increase of an impressive 31% compared to the same period last year. Leading the race are still two giants: China’s BYD and the US-based Tesla.

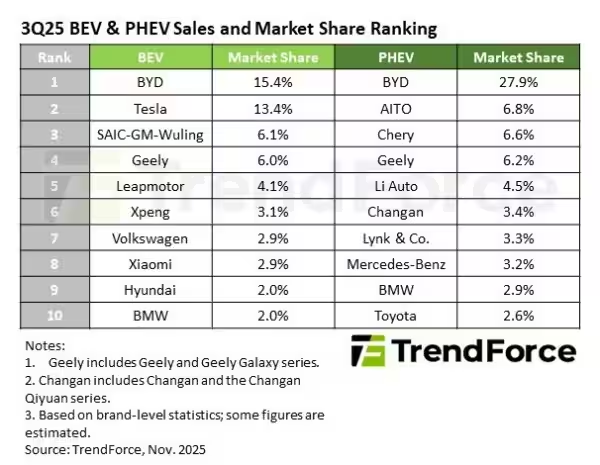

In the pure electric vehicle (BEV) category, BYD holds the lead, albeit by a small margin. The company took 15.4% of the global market, retaining its top spot. It sold 582,522 electric vehicles during the quarter — up 31.37% year-over-year, but down 4.03% from the previous quarter.

BYD sold 582,522 electric vehicles — up 31.37% year-over-year, but down 4.03% from the previous quarter.

Tesla follows right behind, showing a marked acceleration. The company captured 13.4% of the global market and added 29.41% of sales compared to the previous three-month period. In total, Tesla delivered 497,099 electric vehicles during the third quarter. Two key reasons for the success were strong demand in the US ahead of the end of subsidies and a recovery in sales growth in China.

But an even more interesting battle is unfolding beneath the two leaders. Fast-growing brands are gradually taking share away from the big players. Geely has gained 6% of the BEV market and Leapmotor — 4.1%, overtaking XPeng with its 3.1%. Technology companies are also actively entering the race: Xiaomi has already taken 2.9% of the market and climbed to eighth place. At the same time, traditional automakers are faltering: Volkswagen dropped to seventh position due to falling sales in China, despite good demand in Europe and the US. Sales of BMW’s electric cars are also falling, putting pressure on the manufacturer’s annual plans.

The picture is similar in the plug-in hybrid (PHEV) segment. BYD maintains its lead here, too, with a 27.9 percent share. However, the market is becoming increasingly competitive. Despite a slight improvement on the previous quarter (up 0.56%), BYD — 523,069 PHEV sales — were 23.73% lower than a year ago.

At the same time, BYD’s sales — 523,069 PHEVs — were 23.73% lower than a year ago.

Aito took second place, while Chery surged into third position, achieving a 6.6% share thanks to its rapid growth. Geely climbed to fourth place. This is extremely unpleasant news for Li Auto, previously ranked second. The company delivered just 93,211 vehicles — a 39.01% year-on-year drop, reducing its share amid strengthening competitors and the release of new EREV models such as the XPeng X9 PowerX.

The company’s share of the market has fallen as competitors have strengthened and new EREV models such as the XPeng X9 PowerX have been released.

Despite local challenges, the global electric vehicle market will continue to grow. Analysts predict NEV sales will reach 20.43 million units in 2025 — an increase of 25 percent over the current year. Growth is expected to reach 22.8 million in 2026.Changes in government support programs — the end of subsidies in the U.S. and adjustments in China — may cause temporary fluctuations, but the global shift to electric traction will continue to drive the market and propel it to new records.