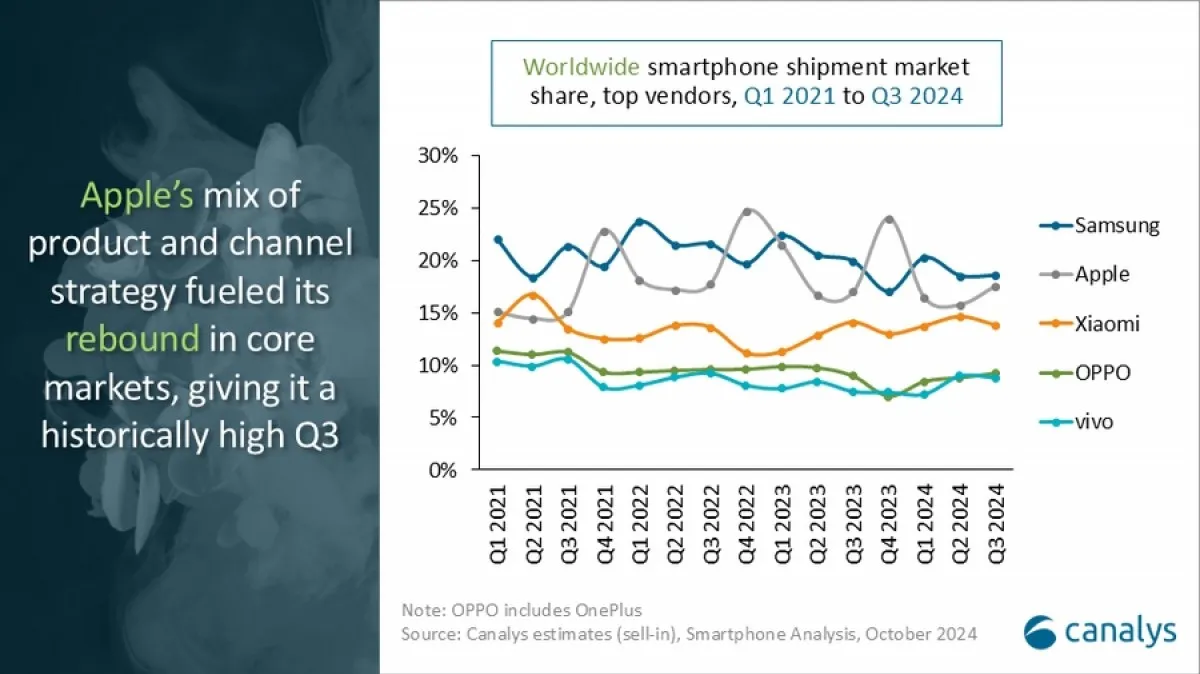

Samsung retains global smartphone market leadership in Q3

According to a report by Canalys, the global smartphone market is showing signs of recovery, achieving its best third quarter result since the start of the pandemic. Around 310 million smartphones were shipped during the July-September 2024 period, the highest since the third quarter of 2021.

Some 310 million smartphones were shipped during the July-September 2024 period, the highest since the third quarter of 2021.

Samsung retained the title of sales leader, but its lead over Apple has shrunk to only one percentage point, with Xiaomi just 4 p.p. behind. Samsung lost 2 percentage points of market share despite optimizing its lineup of budget models. Apple, on the other hand, has almost caught up with Samsung, helped by the launch of the iPhone 16 and successful shipments of older models (e.g. iPhone 13 and iPhone 15) in the Indian market. Analysts expect Apple to take the top spot in the fourth quarter of 2024, although the gap between the leaders may be smaller due to delays associated with the Apple Intelligence feature.

Analytics expects Apple to take the top spot in the fourth quarter of 2024, although the gap between the leaders may be smaller due to delays associated with the Apple Intelligence feature.

Chinese brands Xiaomi, Oppo and vivo have chosen different strategies to boost shipments. Xiaomi focused on sales through its own stores and the open market, while Oppo updated and renamed the A3 series, bringing success in the $100-$200 segment in the Southeast Asian market. The vivo V40 lineup with five different mid-priced models allowed the company to strengthen its presence in several markets at the same time.

| Company | Q3 2024 Shipments (in million) |

Q3 2024 Market share |

Q3 2023 Shipments (in million) |

Q3 2023 Market share |

Yearly change | ||||

| Samsung | 57.5 | 19% | 58.6 | 20% | -2% | ||||

| Apple | 54.5 | 18% | 50.0 | 17% | +9% | ||||

| Xiaomi | 42.8 | 14% | 41.5 | 14% | 14% | +3% | |||

| Oppo | 28.6 | 9% | 26.4 | 9% | 9% | +8% | |||

| vivo | 27.2 | 9% | 22.0 | 7% | +24% | ||||

| Others | 99.4 | 32% | 95.9 | 33% | 33% | +4% | |||

| Total | 309.9 | 100% | 294.6 | 100% | 100% | 5% |

Shipment growth was strongest in the Asia Pacific and Latin America regions, where strong price competition and sales incentive programs supported demand in the budget segment. Canalys notes that low-cost smartphones are important for increasing volumes and market share, but inflationary pressures are limiting their profitability.

Asia Pacific and Latin America.

Predictions for 2025 remain cautiously optimistic. The premium segment is expected to grow in mature markets such as the US, China and Western Europe, where companies will promote devices with AI elements. Vivo and Honor continue to expand their mid-range segment using innovative channel strategies, including pop-up stores and carrier partnerships, to attract buyers for upgrades in the $100-$200 budget segment.

Vivo and Honor will continue to expand their mid-range segment using innovative channel strategies, including pop-up stores and carrier partnerships, to attract buyers for upgrades in the $100-$200 budget segment.