Dogecoin hits weekly death cross – is this the bottom or just the start of the slide?

Dogecoin triggered a rare weekly death cross as its 20-week EMA dipped below the 200-week EMA. Traders are divided on whether last week’s $0.08 test marks a reset in the cycle or merely the opening act of a deeper selloff. The answer could shape not just DOGE’s fate but also how risk appetite is gauged through the lens of meme coins.

Dogecoin’s weekly death cross

The indicator worked as expected on the weekly charts: Charting Guy noted that historically, the 20-week EMA crossing below the 200-week EMA lined up with Dogecoin capitulation-and that signal lit up just last week. He also shared that he boosted his position by 50% near the lows and was actively sending signals to the community-a classic mix of technical analysis and behavioral trading around meme tokens.

DOGE typically bottoms around when the 20 weekly EMA crosses below the 200 weekly EMA. That happened last week.

Charting Guy, analyst/X account

But not everyone is reading the moving averages in isolation. Some analysts see the bounce off $0.08 as a constructive pullback-a trading range rather than a confirmation of a fresh uptrend.

DOGE decent price action here over the past few days after the big $0.08 test last week. Currently seeing this $0.08-$0.13 area as a large range. Anything above that point would make me confident in a further move towards the Daily 200MA/EMA. Currently near the middle so hard to really assume a direction here the way it’s trading.

Daan Crypto Trades, trader/X account

Support levels, range, and liquidation risks

Here’s a quick rundown of the key numbers traders are watching:

- $0.08 – crucial test zone where last week’s lows settled.

- $0.08-$0.13 – current broad trading range, with DOGE hovering around $0.10-$0.11 near the middle.

- Daily 200 MA/EMA – the bulls’ upper target if the range holds.

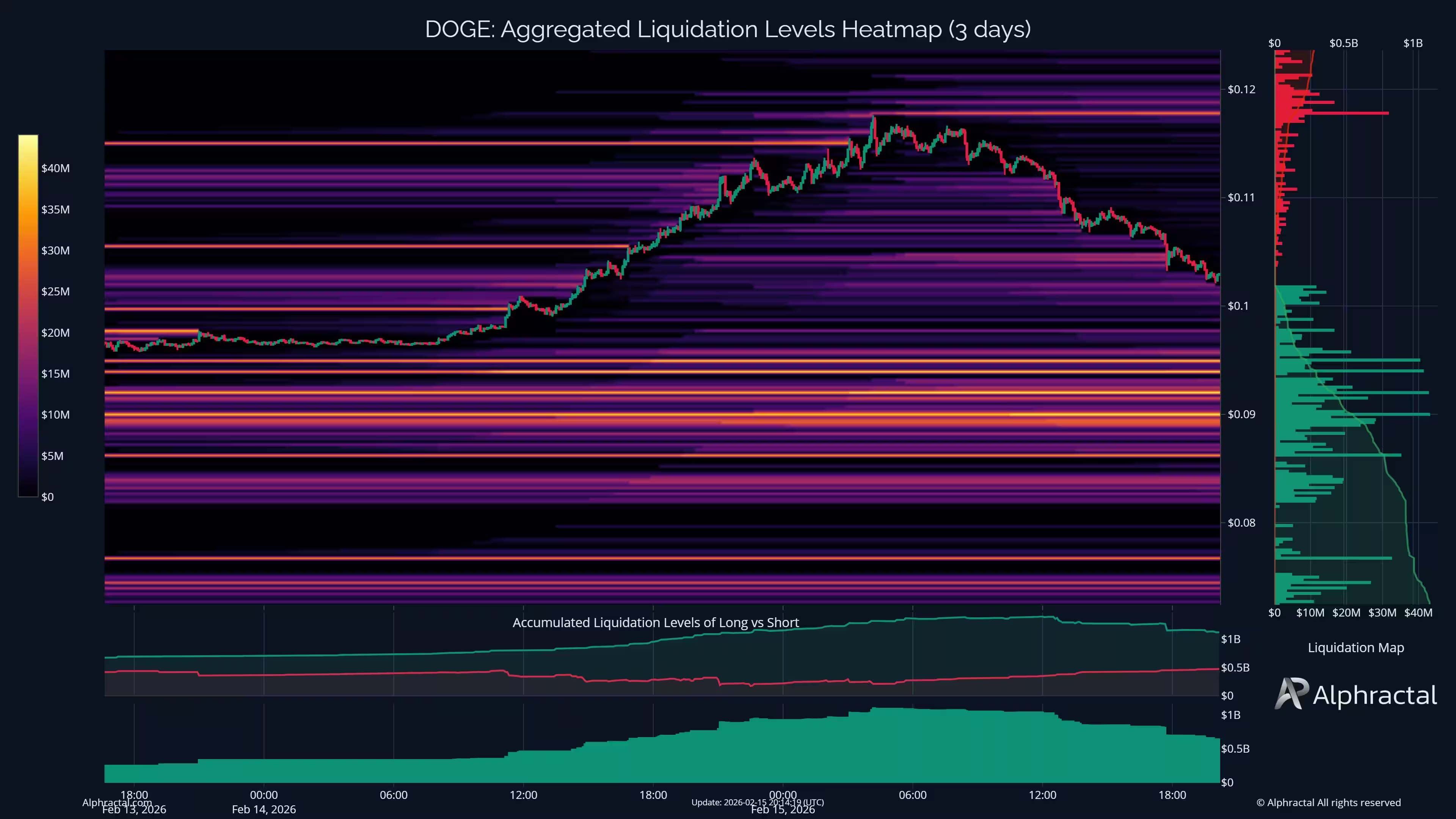

Just “staying range-bound” is precarious with high leverage. Aggregated liquidation heatmaps from Alphractal reveal dense stop-loss clusters below the current price. Alphractal’s CEO, João Wedson, warned that long DOGE positions risk forced liquidations if prices keep falling-and these stops could trigger a cascade turn from choppy trading into a sharp downtrend.

The reason DOGE is under wider scrutiny than just as a standalone coin: meme coins have been noticeably outpacing BTC and most altcoins in trading activity lately. According to Alphractal, Dogecoin’s trading volume topped that of all other meme coins-but that segment recently started to cool off, while Bitcoin stayed relatively steady. That dynamic means DOGE often serves as a short-term gauge of market risk appetite.

What to watch in the coming days

If bulls can firmly reclaim the upper $0.08-$0.13 range, it paves the way to challenge the daily 200 MA/EMA and lowers the chances of a major selloff. But if prices slip back to $0.08 and fail to hold on a second test, stop orders and margin liquidations could accelerate the decline-a particularly dangerous scenario given the high leverage many traders are carrying.

At the time of writing, DOGE was trading around $0.10. In the sessions ahead, the market needs to either show a clear pickup in demand above the top of the range or confirm that $0.08 was just a brief pause on the way down. For leveraged longs, this is far more than a technical chart pattern-it’s a question of position survival.