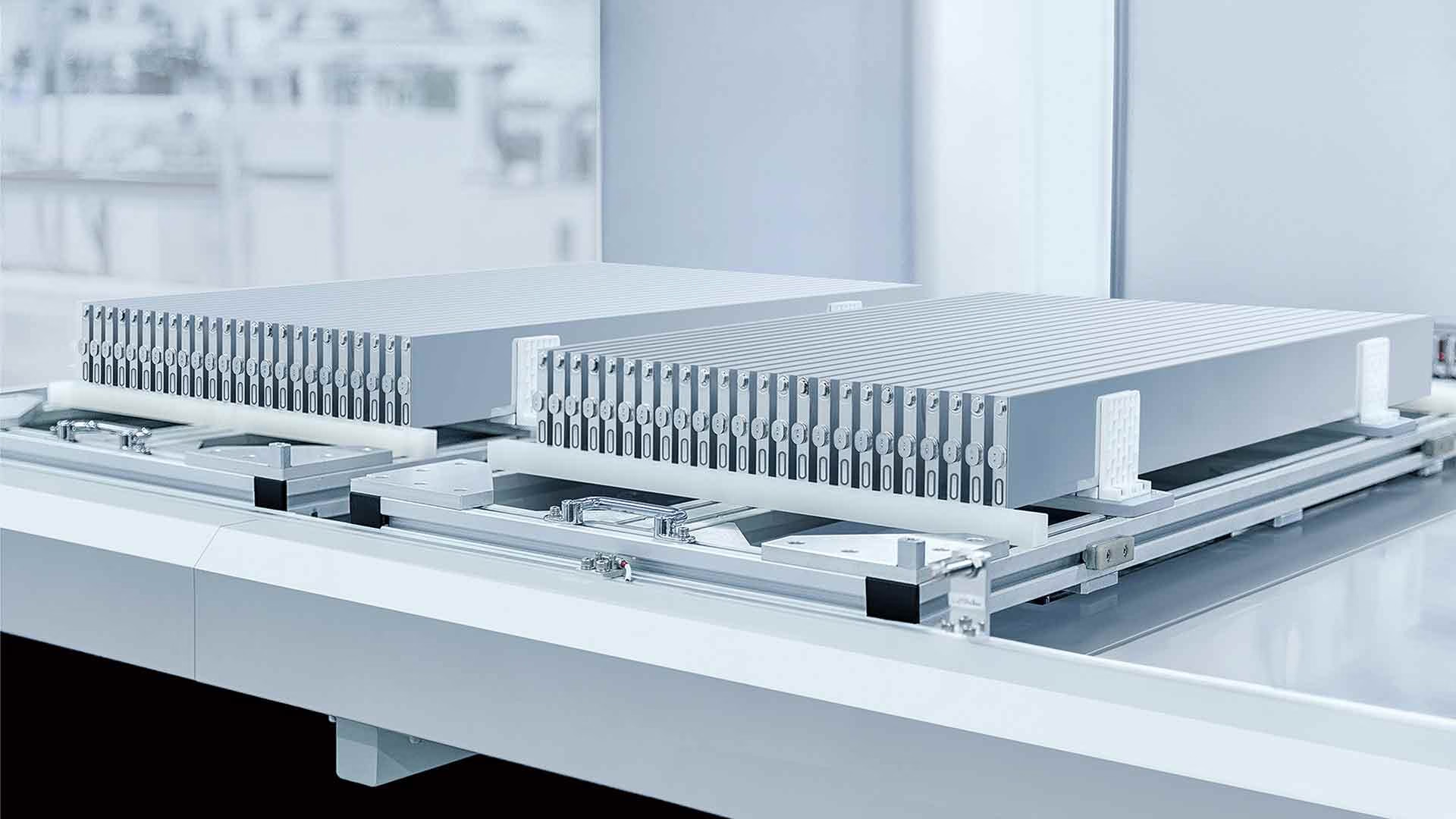

Electric car battery prices fall 20% in 2024

Good news for those thinking about buying an electric car: the batteries that power these vehicles have gotten markedly cheaper in the past year. According to a report from the International Energy Agency (IEA), the average cost of lithium-ion batteries will drop by 20% in 2024. That’s the largest price drop since 2017.

There are several reasons for this trend at once. More manufacturers have entered the industry, competition has intensified, and as demand for electric vehicles has grown, factories have increased production volumes and begun to more aggressively adopt cost-cutting technologies.

IEA notes that the price of lithium, a key raw material for batteries, has fallen by nearly 20%, back to 2015 levels. And the world will use six times more lithium in 2024 than it did then. But the agency warns that if prices remain low for too long, it could stall investment in new mining projects.

IEA says the price of lithium, a key raw material for batteries, has fallen by almost 20%, back to 2015 levels.

The biggest price declines were seen in China, which is not surprising – the country is leading the global battery race. Not only is China self-sufficient in resources, but it is also ahead of the competition in developing new battery technologies. According to the IEA, 80% of all battery cells for electric vehicles in 2024 will be made in China.

According to the IEA, China is the largest producer of battery cells in the world.

The report attributes this to “fierce competition” in the domestic market: manufacturers operate on low margins, which forces them to maximize efficiency and develop a skilled workforce. This has significantly extended their advantage over the US and Europe.

LFP (lithium-iron-phosphate) batteries have played a major role in the Chinese success. They were previously considered a budget option with a shorter range, but continuous technological development has greatly improved their performance. Today, LFPs have become an attractive option for mainstream models.

According to the IEA, LFP batteries will account for nearly half of the total global electric vehicle battery market in 2024. In Europe, their use has grown by 90%, and in Southeast Asia, Brazil and India they have taken more than 50% of the market – largely due to supply from China, especially BYD, but also local production, such as from Tata Motors in India.

According to the IEA, LFP batteries have become an attractive option for mass-market models.

The US is still lagging behind, with LFP’s share here at just 10%, partly due to duties on Chinese goods. Meanwhile, South Korea and Japan are actively developing their own LFP technologies.

The US is lagging behind, with only 10% of LFP share, partly due to Chinese tariffs.

Interesting fact: despite their smaller size, batteries for hybrid cars cost more per kW⋅h. The reason is that the permanent components (housing, electronics, etc.) affect the price equally in both large and small batteries. This is why hybrids are more expensive per kW⋅h.

In 2024, according to the report, a 20 kW⋅h battery for a plug-in hybrid would cost about the same as a 65 kW⋅h battery for a full electric car.

In the US, automakers like GM, Ford and Toyota are ramping up their own battery production, following the lead of Tesla and its Gigafactory in Nevada. Last year, U.S. battery factory capacity increased by nearly 50%, with 70% of the growth coming from Korean companies attracted by tax incentives.

At the same time, the U.S. is increasing its battery production capacity by nearly 50%, with Korean companies attracted by tax incentives accounting for 70% of the growth.

The U.S. has now overtaken the EU in installed production capacity, although Europe also showed a 10% increase. But there’s a threat looming over American progress – the Big, Beautiful Bill being debated in Congress could repeal current tax incentives that support demand for electric cars and domestic battery production.

Material Battery prices for electric cars to fall 20% in 2024 was first published on ITZine.ru.