Trump softened rhetoric on tariffs amid threat of empty shelves and collapsing markets

On Monday, the US president came under pressure on two fronts – from major corporations and the stock market. But on Tuesday, he changed his tone, easing his rhetoric toward China and refraining from direct attacks on the Federal Reserve.

The significance of the moment is that Trump remains committed to radically reshaping the U.S. economic model. But in doing so, he is closely monitoring stock market reactions and heeding alarm bells from influential businessmen and investors who fear the disastrous consequences of his policies.

At the same time, he’s keeping a close eye on stock market reactions and listening to alarm bells from influential businessmen and investors who fear the disastrous consequences of his policies.

Business pressure and the collapse in the markets

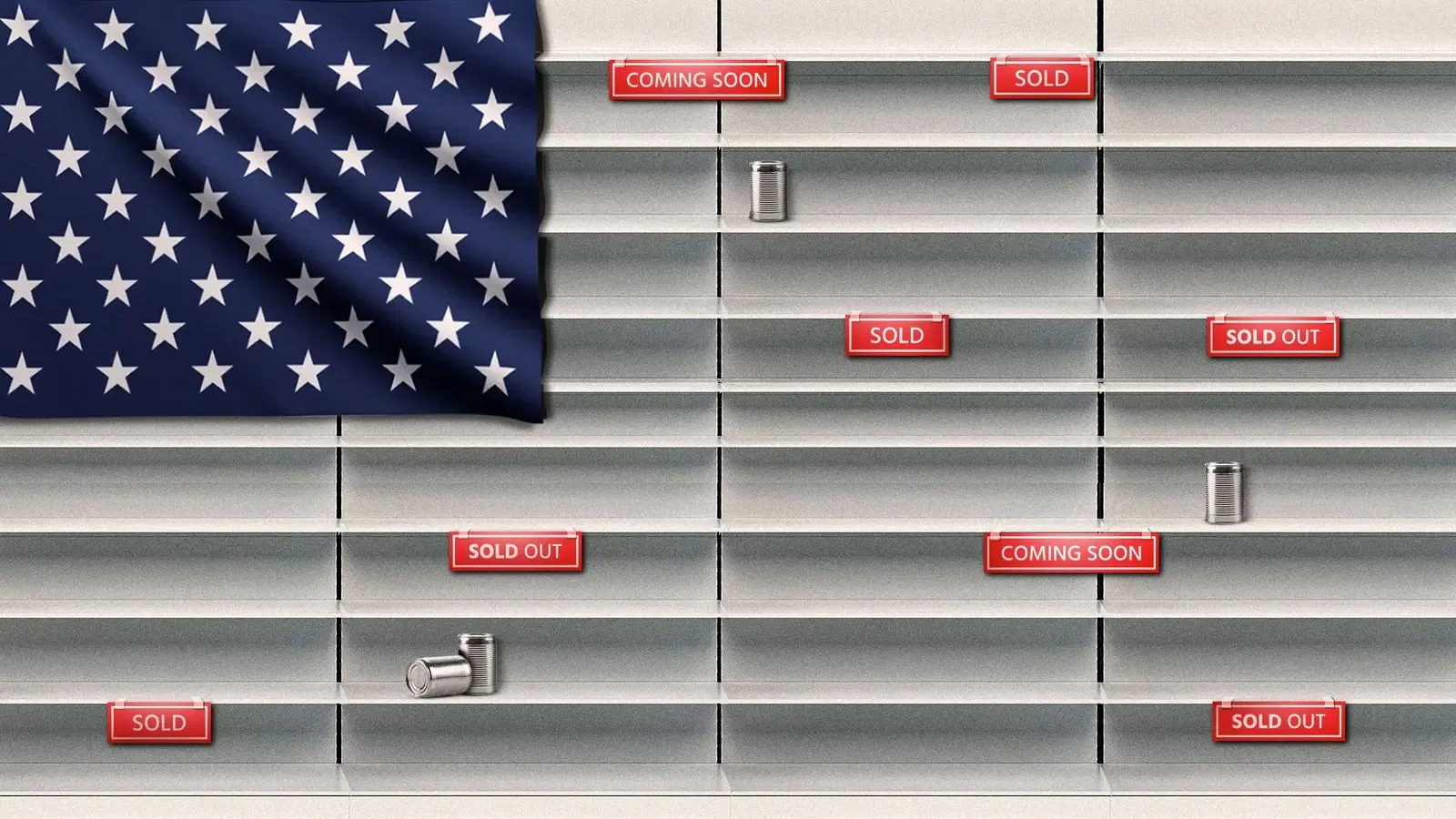

It’s been a tough start to the week for the president’s ambitions to globally reshape the economy. According to sources familiar with the situation, the heads of three major U.S. retailers – Walmart, Target and Home Depot – warned Trump in a closed-door meeting about the serious risks posed by his tariff policies and trade initiatives.

According to one official who attended the meeting, the businessmen told the president that while prices have remained stable for now, they will inevitably start to rise soon. Though the conversation didn’t concern food, Trump was told bluntly, “the shelves are going to empty.”

Another source said the meeting participants estimated that the effects of the tariff decisions would become apparent in a couple weeks. At the same time, financial markets panicked. Investors negatively perceived the president’s threats to fire Fed Chairman Jerome Powell, which caused a fall in stocks, bonds and the dollar.

Turn in rhetoric

The very next day, the Trump administration changed course. First the Treasury secretary, then the press secretary, and then the president himself made it clear: trade talks with China will resume soon and are proceeding in a positive way. Moreover, the outcome of the talks is expected to bring tariffs well below the current level of 145%.

At the end of the negotiations, tariffs are expected to be substantially lower than the current level of 145%.

Trump also told reporters in the Oval Office that he has no plans to fire Powell, despite his top economic adviser admitting the possibility last week. Financial markets immediately reacted with a surge, with stocks and the dollar beginning to strengthen rapidly.

A real or tactical retreat?”

Some White House officials have denied that the president has made concessions. One senior official said Trump is simply showing a willingness to make a deal while staying true to his strategy of pressure.

Some White House officials said Trump is simply showing a willingness to make a deal while staying true to his pressure strategy.

“That’s Donald Trump’s style,” the source said. – ‘He operates through pressure. He drives opponents to the negotiating table. Now China has shown interest in dialog, and the president has made it clear: If they’re willing to cooperate, so is he.”

Changes in Trump’s entourage

The turn in rhetoric coincided with changes among the president’s closest advisers. Treasury Secretary Scott Bessent, according to media reports, has gained more influence in recent weeks and has been actively pushing Trump to soften his stance for the sake of stabilizing markets. So actively, in fact, that he has sometimes appeared in the Oval Office in the absence of other advisers to persuade the president to change course.

Looking from afar: warning signs for the U.S. economy

For the first time in Trump’s time in politics, a majority of Americans have a negative view of his economic policies. Despite the president’s claims of “little inflation,” inflation remains prominent, economic growth is slowing, and manufacturing companies are losing confidence in the future.