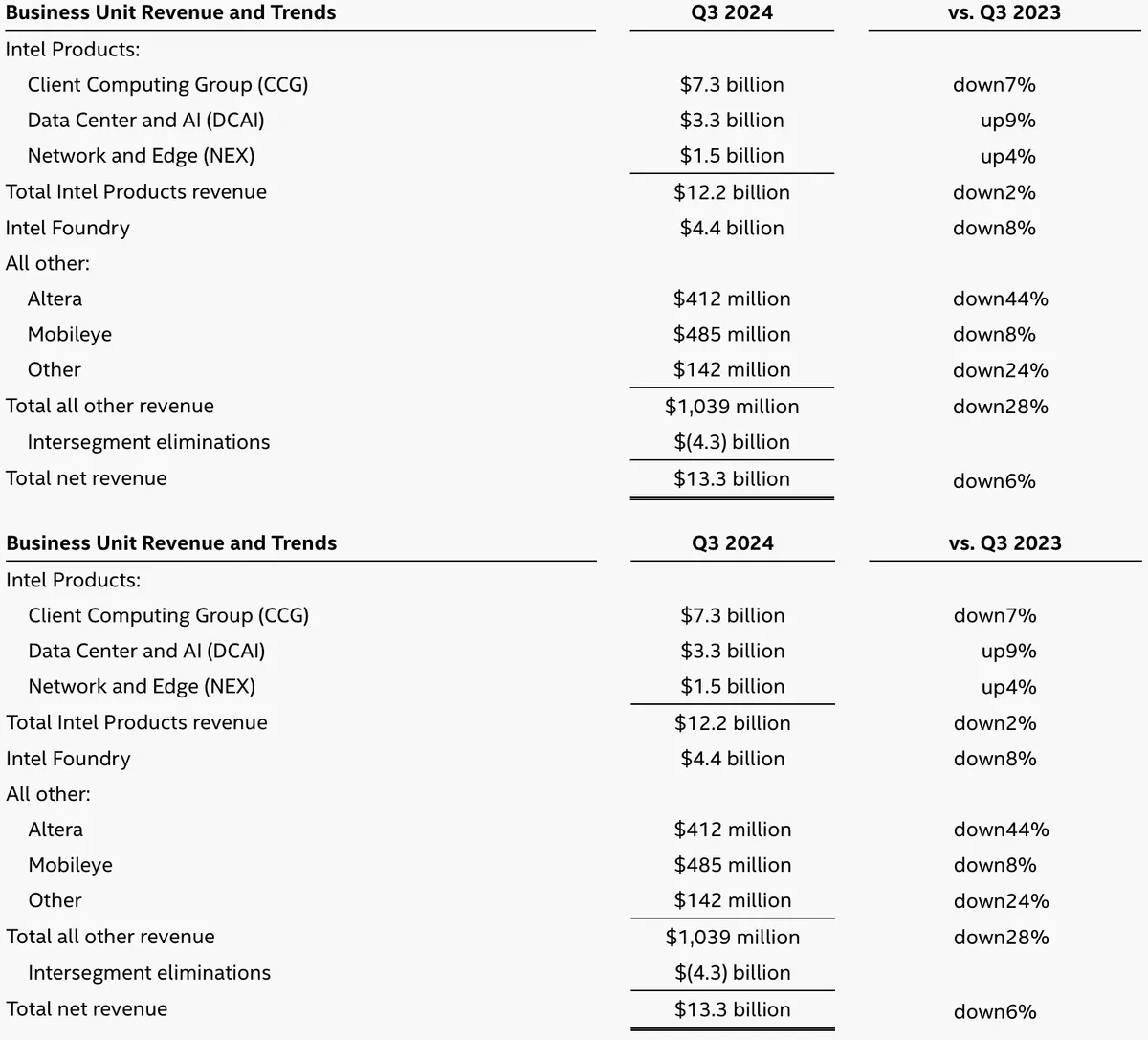

Intel reported a $16.6 billion loss for the third quarter on revenue of $13.3 billion

On Thursday, Intel reported its financial results for the third quarter of 2024. Despite reporting revenue of $13.3 billion and exceeding expectations, Intel posted a whopping $16.6 billion loss due to significant amortization and restructuring costs. Surprisingly, the company’s stock initially rose 12%, although the gain later shrank to 7%.

Surprisingly, the company’s stock initially rose 12%, although the gain later shrank to 7%.

Revenue and margin figures

Intel reported revenue of $13.3 billion, down 6% year-over-year but $0.5 billion higher than the second quarter. However, the net loss reached an unprecedented $16.6 billion due to huge costs in the manufacturing division. The company’s gross margin fell to 15%, an all-time low for Intel.

The company’s gross margin fell to 15%, a historic low for Intel.

Intel’s product groups turned a profit with total revenue of about $12.997 billion. The Foundry division earned $4.4 billion, up slightly from $4.3 billion in the previous quarter but down from $4.7 billion in the same period last year. The manufacturing division recorded a loss of $5.8 billion.

The manufacturing division recorded a loss of $5.8 billion.

Intel CEO Pat Gelsinger said, “Our third quarter results confirm that we are making significant progress on our cost reduction, portfolio simplification and efficiency plan. We exceeded our average revenue guidance and continue to work aggressively to create long-term value.”

Intel CEO Pat Gelsinger said.

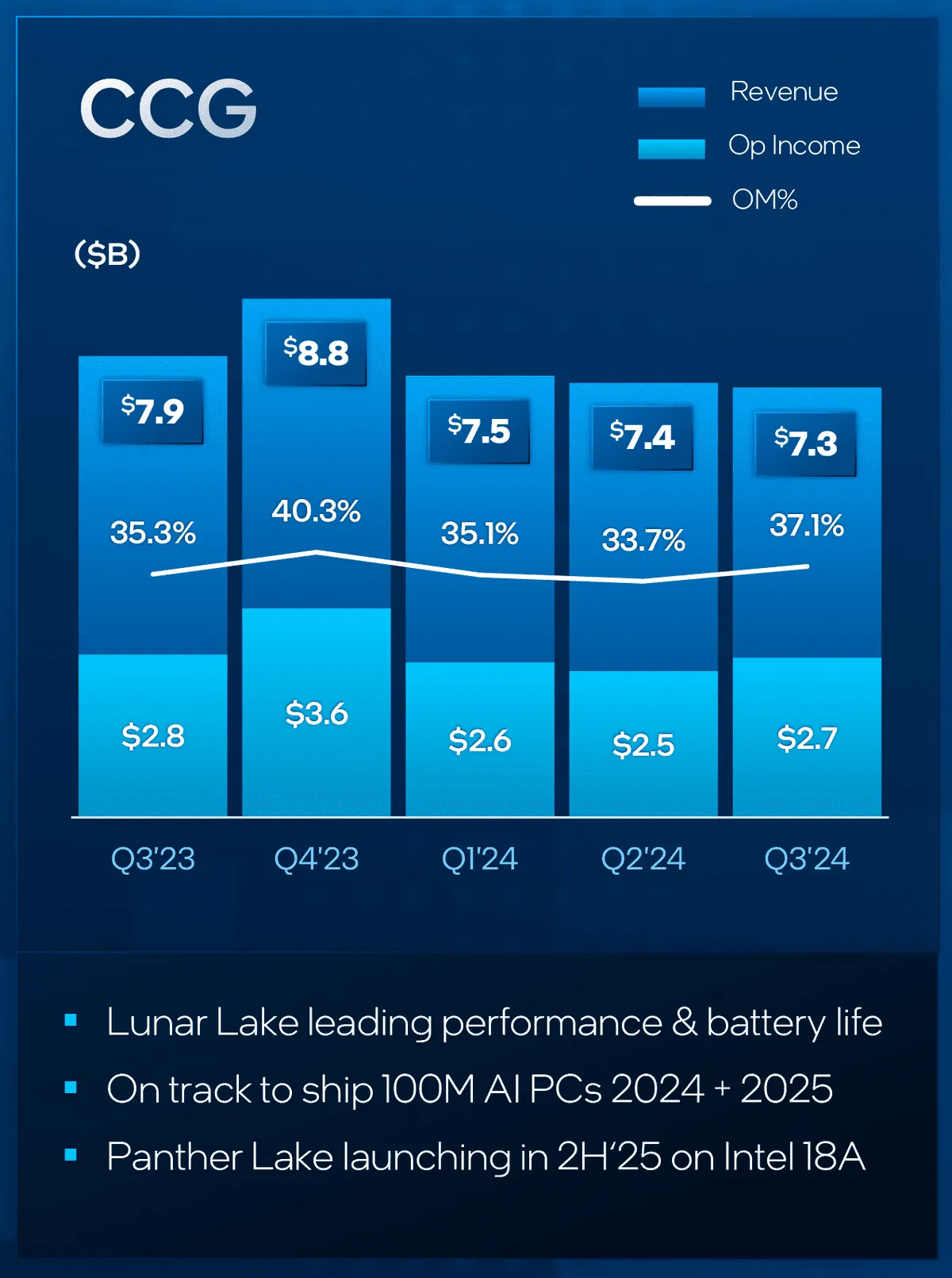

Customer division: modest growth

Intel’s Customer Care Group (CCG) remains the company’s top segment, recording revenue of $7.3 billion for the third quarter. That’s down from $7.9 billion in the same period last year and down $100 million from the previous quarter of 2024. The group’s operating margin was 37.1%, resulting in an operating profit of $2.7 billion.

The group’s operating margin was 37.1%, resulting in an operating profit of $2.7 billion.

In the quarter, Intel began shipping Arrow Lake-S processors for enthusiasts and Lunar Lake chips for compact notebooks. However, these new products have yet to have a significant impact on CCG sales.

Data centers and AI: positive momentum

The Data Center and AI Group (DCAI) division earned $3.3 billion, showing growth in both quarterly and year-over-year terms. Operating margin improved to 10.4%, but operating income was only $0.3 billion, which is surprising given the start of shipments of the high-margin Xeon 6 processors.

According to DCAI, DCAI’s operating income was only $0.3 billion.

The Xeon 6 volumes were probably too low to materially impact DCAI’s numbers, as the company is at the beginning of a major rollout.

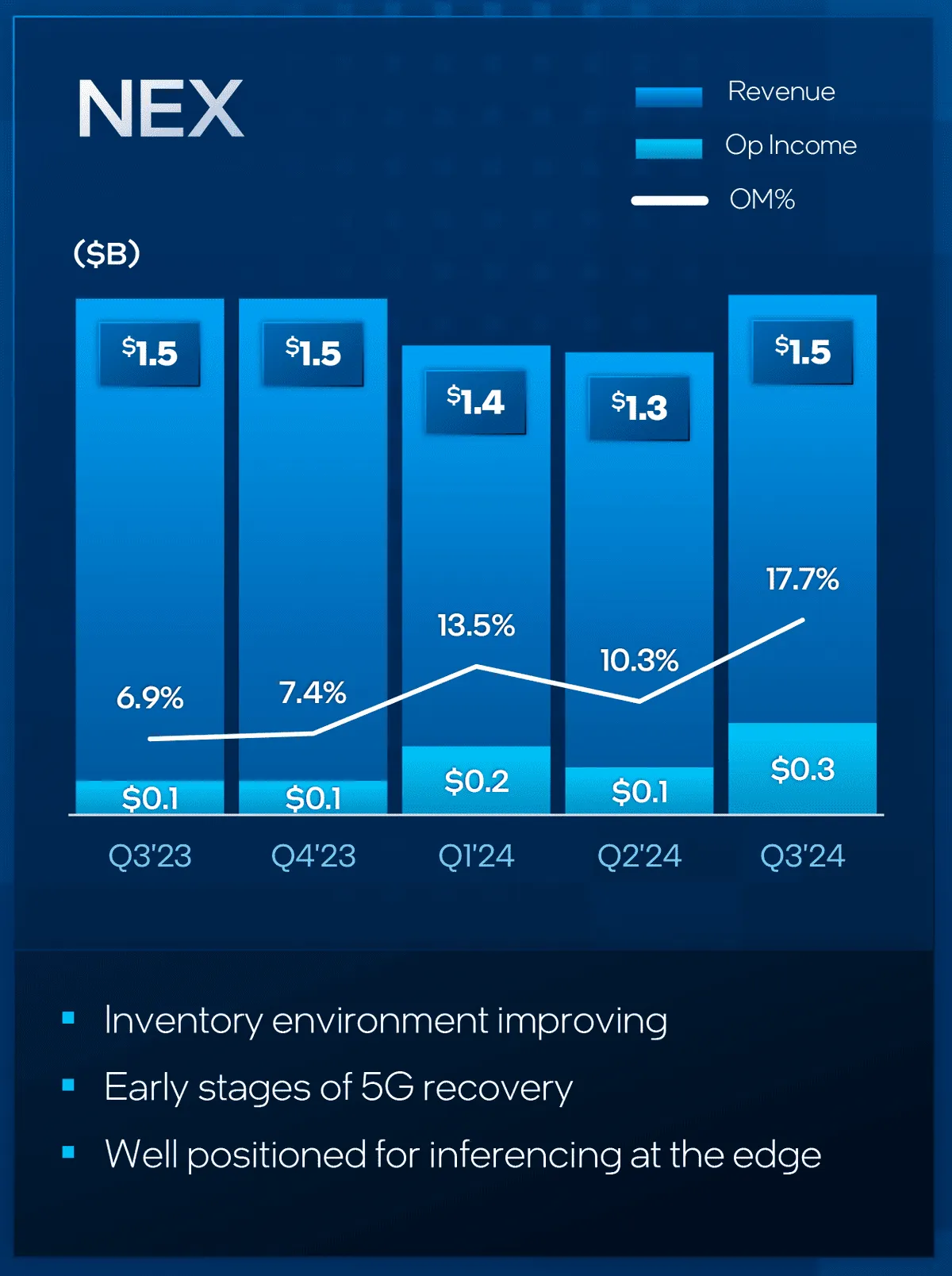

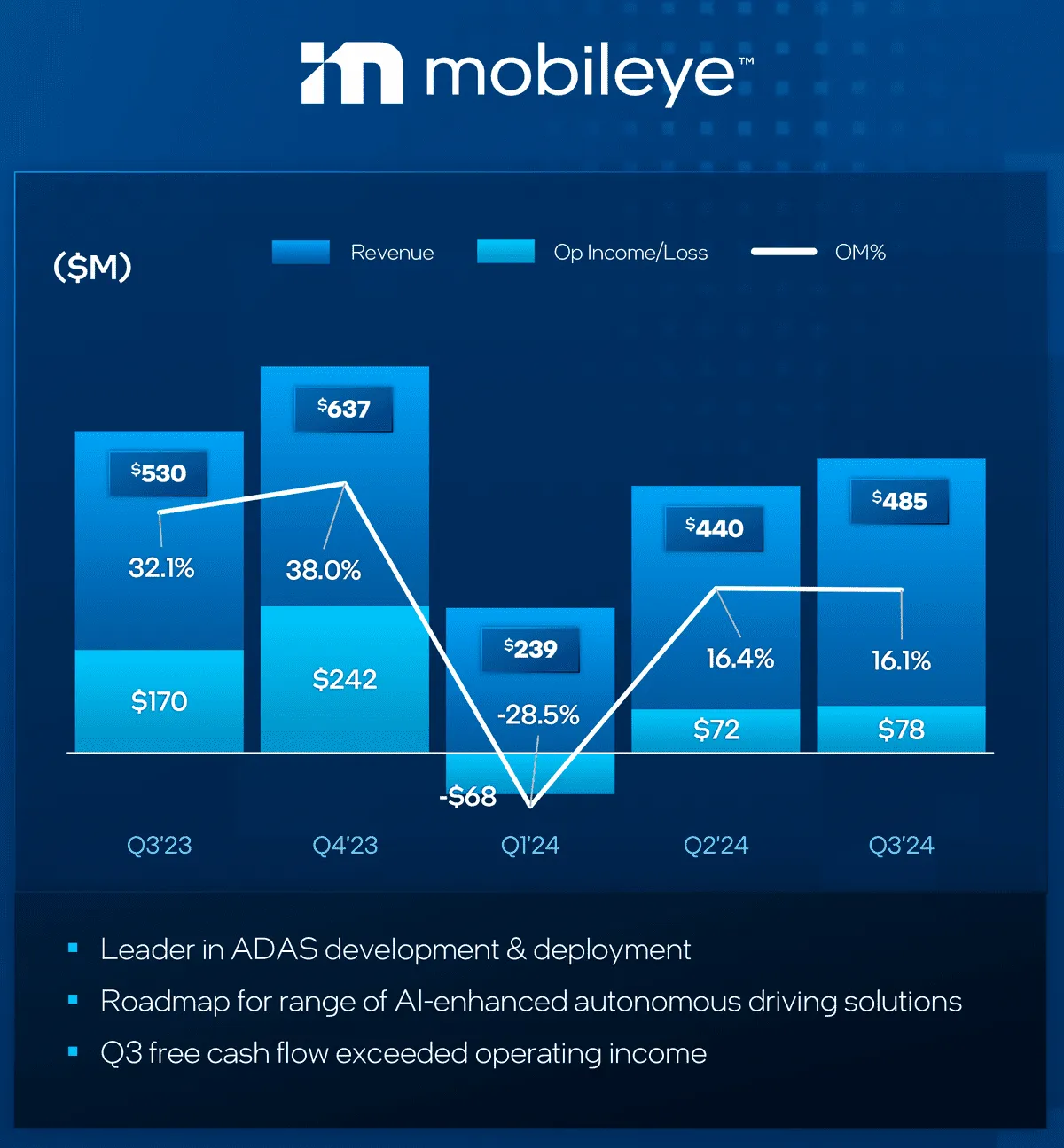

NEX, Mobileye and Altera: mixed results

The NEX division, which develops solutions for 5G, networking and telecom, recorded revenue of $1.5 billion, in line with last year and up $200 million from the previous quarter. Operating income rose to $300 million.

According to the company, operating income rose to $300 million.

Mobileye increased revenue to $485 million, up from $440 million in the second quarter, but still below the $530 million in the same period last year. Segment operating profit was $78 million, down significantly from $170 million a year ago.

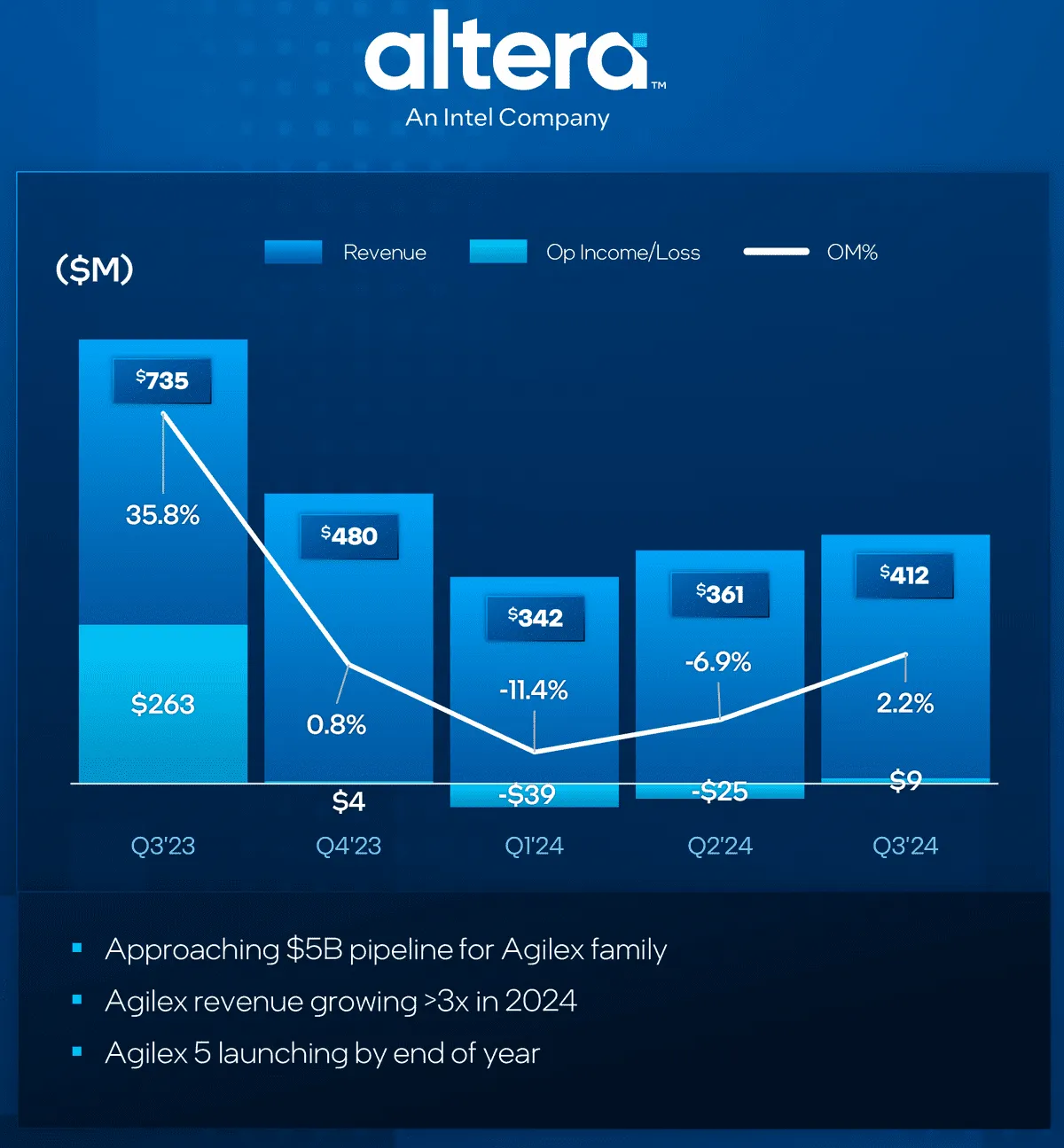

Altera had another challenging quarter, with revenue rising to $412 million from $361 million in the second quarter, but remains well below the $735 million for the third quarter of 2023. The segment recorded a $9 million profit, well below the $263 million a year earlier, but better than the $25 million loss in the second quarter of 2024.

The segment recorded a $9 million profit, well below the $263 million a year earlier, but better than the $25 million loss in the second quarter of 2024.

Future Outlook

Intel forecasts revenue in the range of $13.3 billion to $14.3 billion for the fourth quarter of 2024, down from $15.4 billion in the same period last year, despite a revamped product portfolio. The company also expects gross margin to improve to 36.5%, driven by competitive new product launches and no incremental costs.

The company also expects gross margin to improve to 36.5%, driven by competitive new product launches and no incremental costs.