White House wants 10% stake in Intel – Trump is changing the rules of the game again

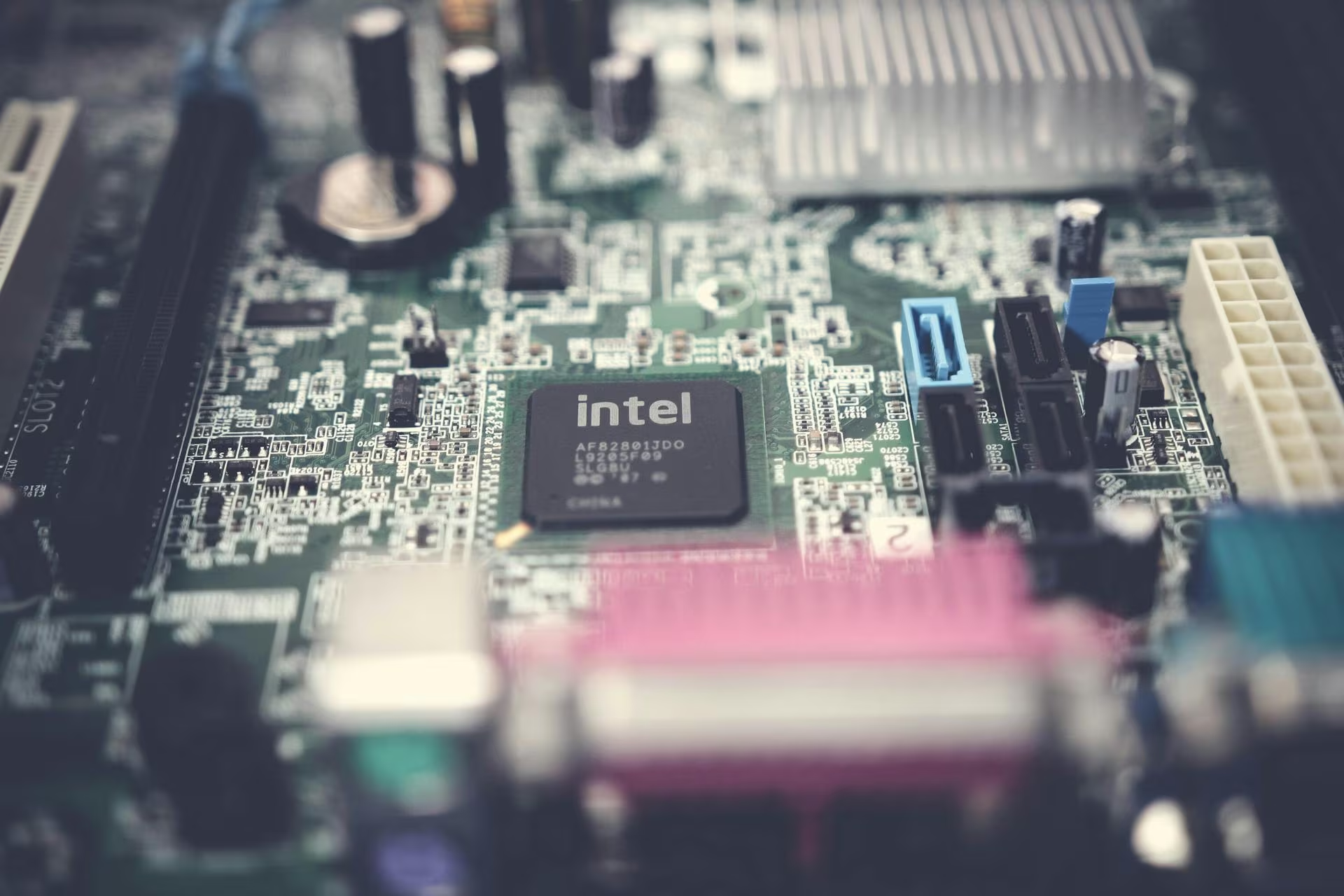

The Donald Trump administration is in talks to convert some government support into a stake in Intel. According to Bloomberg, the White House could convert about $10 billion under the Chips Act program into a 10% stake in the company.

Intel (ticker INTC.O) closed down 3.7% on Monday, despite rising last week amid expectations of government support. The market value of the potential stake is estimated at $10 billion.

Chips Act government funds could go into equity

Intel is set to receive up to $10.9 billion in Chips Act grants – for both commercial and military production. According to Bloomberg, that amount is enough to cover the cost of a 10% stake that could go to the government.

Intel is expected to receive up to $10.9 billion in Chips Act grants for both commercial and military production.

Representatives for Intel declined to comment. The White House did not respond to reporters’ requests for comment, and Reuters could not immediately confirm the information.

Information about a possible U.S. stake in Intel emerged after CEO Lip-Boo Tan met with President Donald Trump. The meeting came amid the head of state’s demand for his resignation over alleged ties to Chinese companies.

The meeting came amid the president’s demand for his resignation over alleged ties to Chinese companies.

State aid could be a bailout for unprofitable businesses

Analysts say state ownership could give Intel more time to rebuild unprofitable contract manufacturing. However, problems with the product line and attracting customers to new fabs still remain.

“If the U.S. government intervenes to save such a flagship company, then its situation was worse than expected,” said David Wagner, head of portfolio management at Aptus Capital Advisors, an Intel shareholder. He added that while there is skepticism about investing public money in private companies, it’s better than government nationalization.

An investment in private companies is better than government nationalization.

Trump steps up intervention in tech sector

In Trump’s own words, the meeting with Thune was “very interesting.” He has been aggressively pushing multi-billion-dollar projects with government involvement in critical industries. Among them are a proposed partnership with Nvidia and a deal with MP Materials to secure supplies of rare earth elements.

That’s why he’s been pushing for the government’s involvement in a number of critical industries.

“This is an attempt by the U.S. to play the Chinese card and gain more control over manufacturing chains,” said Clark Jeranen, chief strategist at CalBay Investments. He said the approach raises free-market concerns, but companies are willing to cooperate, suggesting that the current policy may be temporary.

“This is an attempt by the U.S. to play the China card and get more control over manufacturing chains,” said Clark Jeranen, chief strategist at CalBay Investments.

Lessons from the past: the General Motors experience

Government investments in troubled companies have a history. During the 2007-2009 financial crisis, the government acquired a stake in General Motors, which it later divested from in 2013.

In 2024, Intel has already received about $8 billion in subsidies to build new factories in Ohio and other states. That program was launched by former CEO Pat Gelsinger. However, his successor, Lip-Bu Tan, has curtailed the pace of construction and announced that new facilities will only be built if there is steady demand. That may run counter to Trump’s policy of promoting U.S. manufacturing.