Aviasales put up for sale at 23 billion rubles

The owners of Aviasales, Russia’s largest flight ticket search engine, have started looking for a buyer. The company’s valuation tops 23 billion rubles (around $300 million), but a complex ownership structure and overseas assets could complicate the deal.

- The process is still in preparation, with no concrete talks with buyers yet

- Direct airline sales account for 50-70% of transactions, while online travel agencies split the remaining 30-50%

- Potential buyers could include major banks

Owners prepare for sale

According to two sources from the investment community speaking to Kommersant, Aviasales’ owners are considering selling the business. The process is in the early prep phase, with no firm negotiations underway yet. Another source suggests that the key shareholders, which include investment funds, may currently be gathering offers from interested parties-but “they won’t sell cheap,” they added. Aviasales told Kommersant that “management and shareholders are unaware of any plans by unnamed market players to buy the company.”

Founded in 2007, Aviasales is Russia’s biggest flight search platform. Its founder, Konstantin Kalinov, passed away in 2017. In 2014, the iTech Capital fund acquired a stake in exchange for a $10 million investment. By 2021, iTech Capital and Elbrus Capital had jointly invested $43 million. Today, Aviasales is owned by Hong Kong-based Go Travel Un, with about 35% held by Cyprus-registered Realstory Trading, 34% by iTech Capital funds, and 20% by Cyprus-based Prati Limited. The company’s management holds minority shares.

Valuation and hurdles to the deal

Investment banker Ilya Shumov estimates Aviasales’ current valuation at no less than $300 million (23.16 billion rubles). He points out the challenge of accurately valuing the business due to its significant foreign assets. One Kommersant source notes that the complicated ownership structure, offshore holdings, and high price could all serve as barriers to the sale.

A tourism market insider explains that search engines and booking platforms typically earn through commissions, bonuses, fees, and currency exchange margins. Leonid Pustov, head of the Russian Union of Travel Industry’s startup commission, adds that ticket sales for foreign carriers tend to carry higher profit margins.

Market and potential buyers

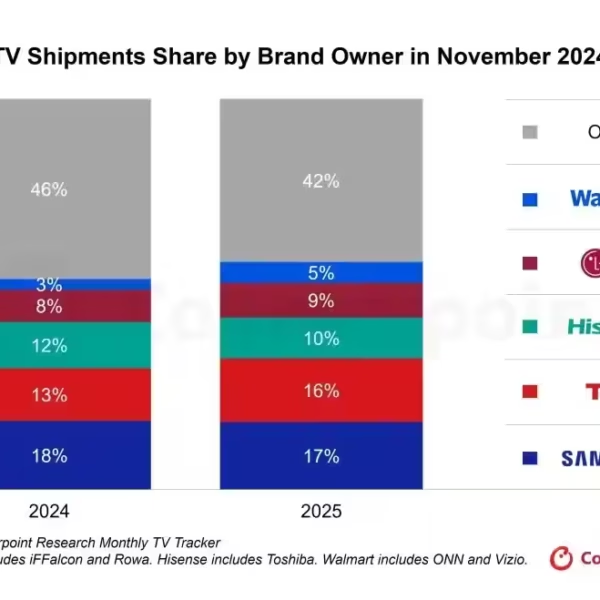

Dmitry Gorin, chairman of the Association of Air Transport Agents, says that direct airline sales retain a strong share, ranging from 50% to 60%. Pustov adds that for some major carriers, this figure can reach up to 70%. The remaining 30-50% is split among online travel agencies.

Online travel agencies face pressure from declining air traffic volume. According to Rosaviatsiya, Russian airlines carried a total of 108.85 million passengers in 2025, down 2.6% year-on-year. This drop is mainly due to a 4% fall in domestic traffic, while international passenger numbers grew by 1.6% over the year.

Ticket distribution costs are also rising. A source told Kommersant this is an upfront business that requires significant investment. They also noted ongoing commission cuts imposed by carriers and intensifying competition. A notable share of buyers are now shifting focus towards banking ecosystems. Financial institutions could be increasingly interested in acquiring Aviasales down the line. For example, there were previous reports about Alfa-Bank negotiating the takeover of aggregator Tutu.ru, although the bank denied those rumors.