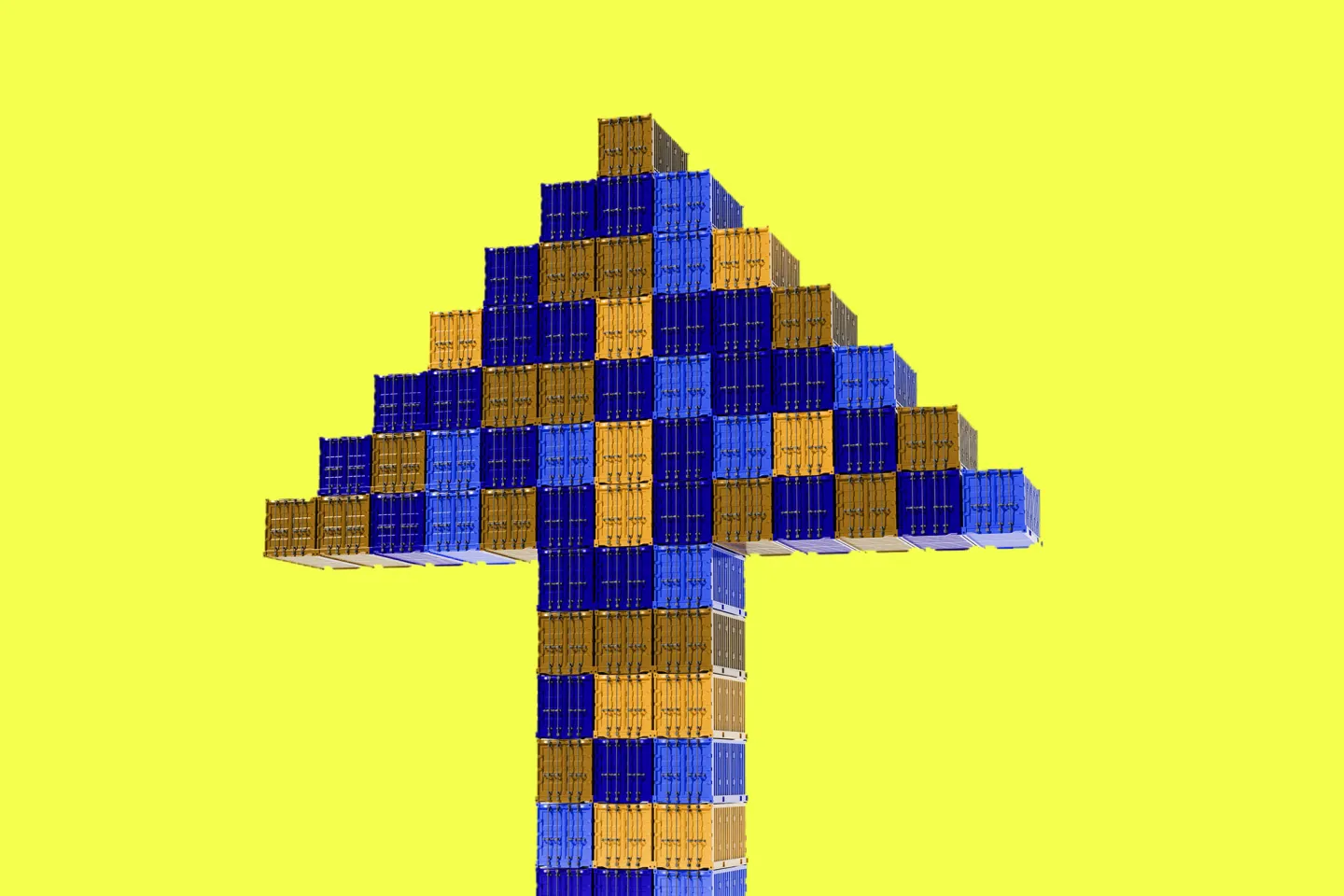

Donald Trump has imposed massive duties: price hikes will affect almost all goods from smartphones to food

At an event in the White House Rose Garden, Donald Trump announced a new economic initiative that could dramatically change the cost of imports into the US – and, as a result, affect global supply chains, including the electronics market. The measures include imposing staggering duties on imports from more than 60 countries, with some as high as almost 50%. This will invariably affect business in the U.S. and will likely impact end consumers around the world.

New tariffs: 10 to 49 percent

According to The New York Times, the announced tariffs include 10 percent of the base rate, on top of which additional percentages are added:

- China – 34% (including the base rate of 44%),

- Vietnam – 46%

- India – 26%

- EU – 20%

- Cambodia – 49%

All of these countries are major suppliers of goods, including technology, clothing, automobiles, electronics, food and more. If the plan is implemented, virtually all categories of consumer goods, including gadgets and components, will be affected.

It’s notable that Russia is not on the list. But most likely the prime rate of 10% will still be in effect.

Technology hit: Apple, Amazon, Temu and Shein at risk

Many U.S. and international companies have already tried to move away from dependence on China. For example, Apple has started to actively shift iPhone production to India. However, a new 26 percent duty on Indian imports could reverse those efforts. Manufacturing alternatives like Vietnam and Cambodia have also come under the “tax squeeze,” at 46 percent and 49 percent respectively.

The business model of retailers like Temu, Shein and Amazon Haul will also be under attack. Trump signed an executive order to repeal the de minimis exemption, which previously allowed no duty on parcels valued up to $800. This was the basis for ultra-low-cost online ordering schemes: users received goods directly from China – without taxes or customs duties. Now that window is closing.

Who really pays for tariffs?

Despite Trump’s claims, the tariffs are not paid by exporters, but by U.S. companies and end consumers. Higher duties increase importers’ costs, which are then transferred to the price of goods for buyers. That means the more taxes, the higher the final cost of smartphones, laptops, home appliances and even groceries in supermarkets.

Economists are already calling the initiative “economically irrational” and comparing it to the Great Depression, when protectionism worsened the crisis.

An economist has already called the initiative “economically irrational” and compared it to the policies of the Great Depression, when protectionism made the crisis worse.

Addition to Old Duties

It’s worth noting that the new tariffs don’t replace existing tariffs – they add to existing restrictions, including taxes on cars and products from Canada and Mexico. This creates a multi-layered system of duties that can seriously overburden international trade.