Nvidia shares up 4% after dividend announcement

In an investor call Wednesday, Nvidia (NVDA) reported first-quarter earnings that beat expectations and also announced a 10-for-1 stock split and a dividend increase, following some of its peers in the tech community that pay out larger quarterly distributions to shareholders.

At a call with investors Wednesday, Nvidia (NVDA) reported first-quarter earnings that beat expectations and also announced a 10-for-1 stock split and dividend increase, following some of its peers in the tech community that pay out larger quarterly distributions to shareholders.

The company reported adjusted earnings per share (EPS) of $6.12 on revenue of $26 billion, up 461% and 262%, respectively, from a year ago. Analysts had expected adjusted EPS of $5.65 on revenue of $24.69 billion, according to data compiled by Bloomberg. In the same quarter a year ago, adjusted EPS was $1.09 on revenue of $7.19 billion.

An adjusted EPS of $1.09 on revenue of $7.19 billion.

Nvidia expects revenue of $28 billion plus or minus 2% for the current quarter. That’s better than the $26.6 billion analysts expected. Nvidia shares were up 4 percent in extended trading Wednesday.

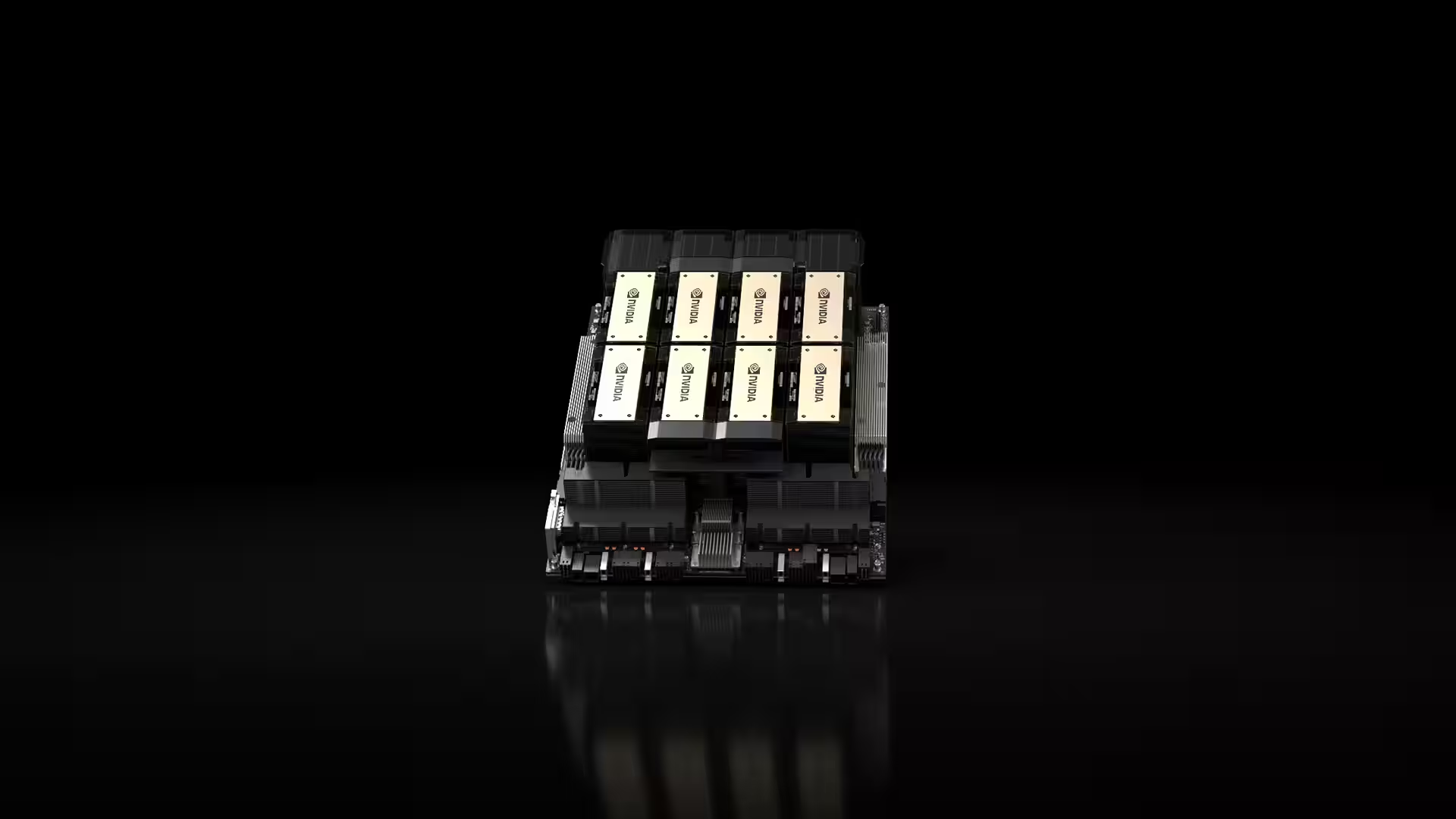

«Our data center growth was driven by strong and accelerating demand for training and output of generative AI on the Hopper» platform, — Nvidia CEO Jensen Huang said in a statement. «In addition to cloud service providers, generative AI has spread to consumer internet companies as well as enterprise, sovereign AI, automotive and healthcare, creating multiple multi-billion dollar vertical markets».

And generative AI has spread to consumer internet companies as well as enterprise, sovereign AI, automotive and healthcare, creating multiple multi-billion dollar vertical markets.

.

Wall Street analysts have previously raised concerns about the share of Nvidia’s data center revenue coming from hyperscale companies like Microsoft (MSFT), Google (GOOG, GOOGL), Amazon (AMZN) and other large tech companies. This is especially true as these companies deploy their own AI gas pedal chips.

So far, these companies are not only scaling their own AI gas pedal chips, but they are also deploying their own AI gas pedal chips.

While the use of Nvidia chips in non-hyperscale systems is growing, CFO Colette Kress said in a commentary that large cloud providers account for about 45% of the company’s data center revenue.

Nvidia’s data center revenue jumped 427% year over year to $22.6 billion, accounting for 86% of the company’s total revenue for the quarter. However, Kress noted that revenue from China fell significantly in the quarter as the company was forced to stop shipping its most powerful chips to that country. Moreover, she said, she expects the market in that region to remain very competitive going forward.

She said she expects the market in that region to remain very competitive going forward.

Nvidia’s gaming segment, which used to be its most important business, generated $2.6 billion in revenue.

Nvidia’s gaming segment, which used to be its most important business, generated $2.6 billion in revenue.