Rumor: Qualcomm shifts Snapdragon production from TSMC to Samsung Foundry factory

Samsung Foundry, which has been actively working to fix long-standing problems with low yields, could gain a significant advantage over TSMC. According to a recent report, global semiconductor leader TSMC risks losing some 2nm chip orders to Samsung. This could be revenge for Samsung, which previously lost a major customer to Qualcomm, which decided to shift Snapdragon 8 Gen 1 production to TSMC because of Samsung’s low yields.

The Importance of Year-End Chip Yield

In semiconductor manufacturing, chip yield refers to the percentage of functional chips obtained from a single silicon wafer. For mass production, a 70% yield is considered acceptable. However, TSMC’s test runs on 2nm technology show only 60% yield, which is below the required level. Despite this, rumors are emerging that Nvidia and Qualcomm are considering moving 2nm chip production from TSMC to Samsung Foundry.

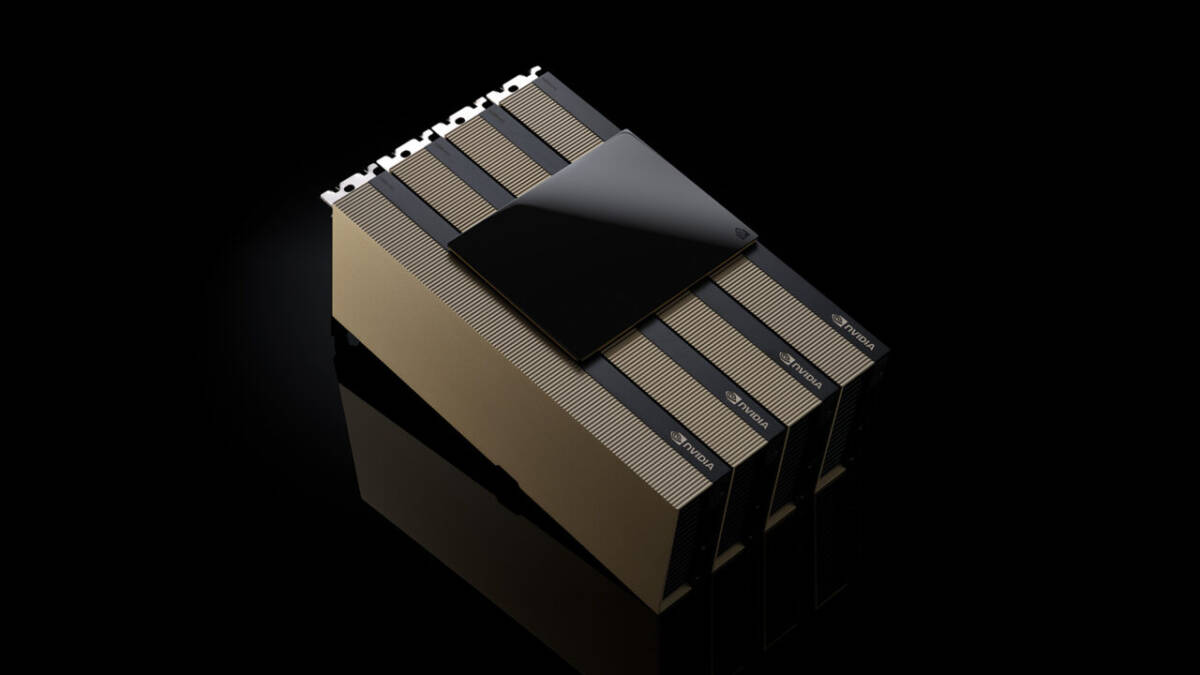

And rumors are emerging that Nvidia and Qualcomm are considering moving 2nm chip production from TSMC to Samsung Foundry.

Rising costs and limited capacity

TSMC’s high costs and limited production capacity are the two main factors contributing to a possible change of manufacturer:

- Price increases: TSMC reportedly plans to increase prices of advanced chips by 5-10% in 2025. The cost of silicon wafers for 2nm chips is rumored to increase by 50% to $30,000 per wafer, further increasing overall customer costs.

- Limited capacity: Apple, TSMC’s largest customer, has allegedly reserved most of its initial capacity for 2nm chips. That leaves little room for other customers, prompting companies such as Nvidia and Qualcomm to look for alternatives.

.

Opportunities and Challenges for Samsung Foundry

Although Samsung Foundry may benefit from TSMC’s capacity constraints, it has its own challenges to deal with. In the past, Samsung has faced low yields of year-round chips, which offset possible savings for customers due to the need to use more wafers to get the required volume of production. However, if Samsung manages to improve chip yields, it will become an attractive alternative for companies looking for 2nm production.

Samsung’s low chip yields will make it an attractive alternative for companies looking for 2nm production.

TSMC’s plans for the future

TSMC, which held 64.9% of the global semiconductor fabs market in the third quarter of 2024, has ambitious plans to expand 2nm chip production. The company aims to increase capacity from 10,000 wafers in trial production to 80,000 wafers per month by 2026. This expansion could partially relieve current constraints and reinforce TSMC’s dominant position in the long term.

The expansion could be a major boost to TSMC’s long-term dominance.

Perspectives

As the semiconductor industry transitions to 2nm technology, competition between TSMC and Samsung Foundry is intensifying. Samsung’s possible resurgence, driven by improved yields of year-old chips and proactive customer outreach, could change the market dynamics. However, TSMC’s reputation, significant market share and plans to increase production capacity make the race for leadership far from over.