How China is challenging Nvidia’s dominance of the AI chip market

The US has held the lead in the global tech industry for decades. China is set to change the balance of power by investing billions in artificial intelligence, robotics and, most importantly, its own high-performance microchips.

China accelerates the pace

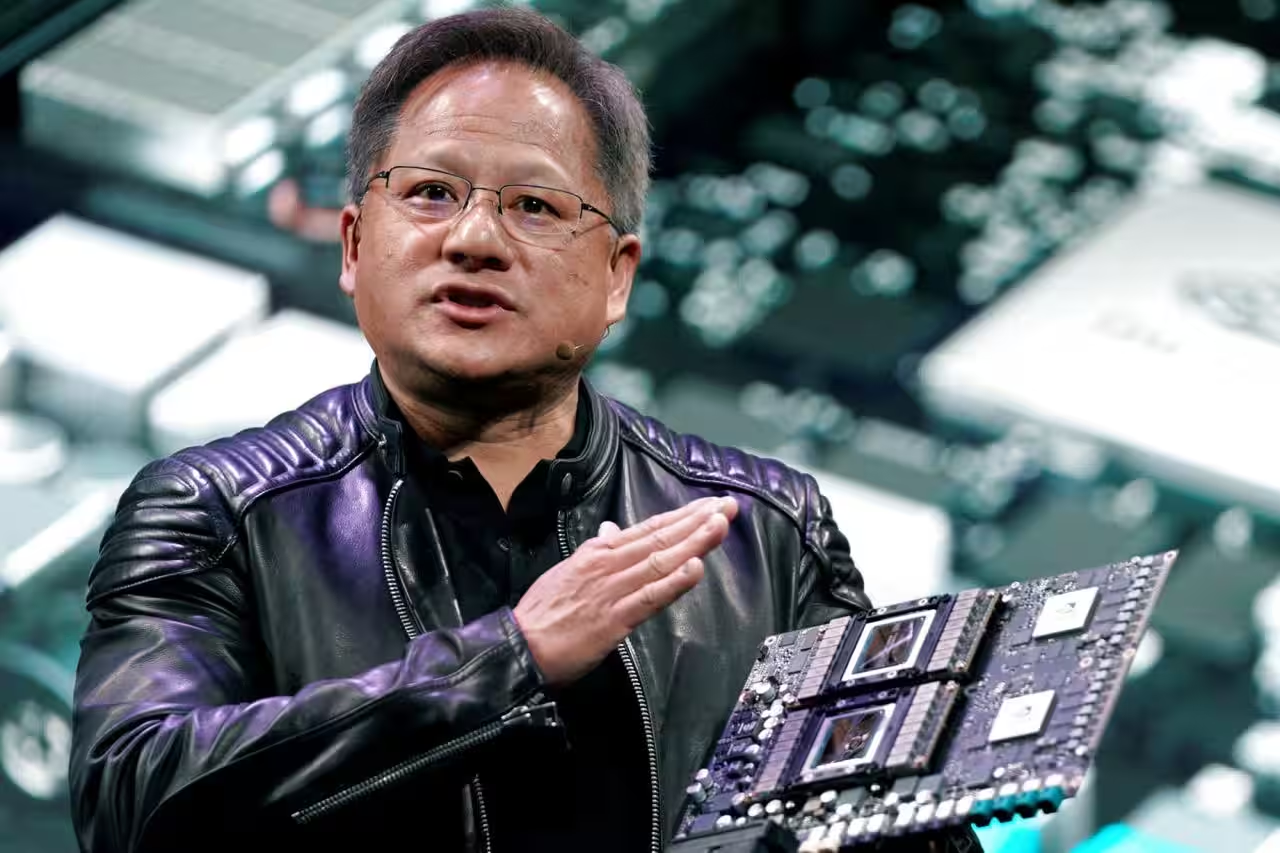

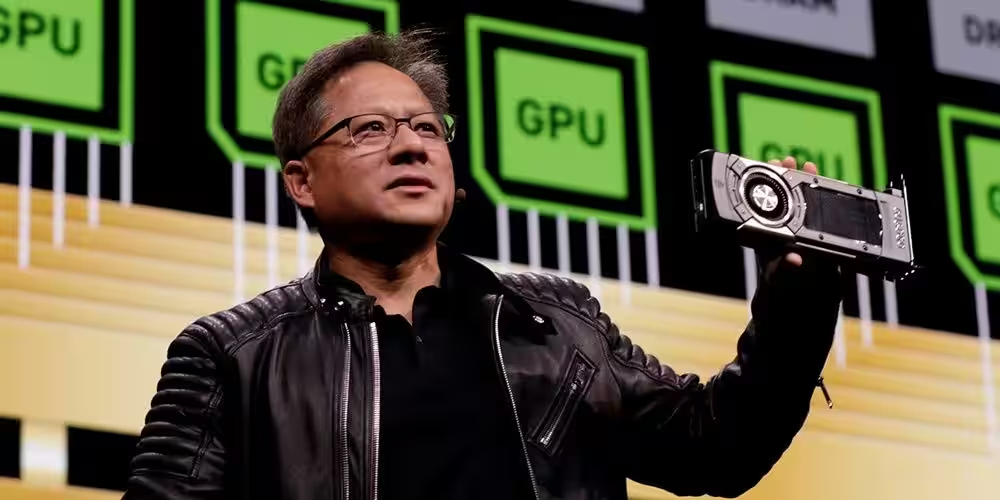

Nvidia CEO Jensen Huang recently admitted: China is only «a few nanoseconds» behind the U.S. in chip development. And while parity is still a long way off, Beijing is stepping up efforts to reduce its dependence on U.S. supply.

The revolution began after the success of Chinese startup DeepSeek, which introduced a counterpart to ChatGPT in 2024. The model required significantly less powerful chips than OpenAI solutions and temporarily crashed Nvidia’s capitalization.

And it was the first time that Nvidia’s capitalization had been temporarily crushed.

Since then, major Chinese companies — Alibaba, Huawei, Cambricon, MetaX and Tencent — have openly announced plans to compete with the U.S. giant.

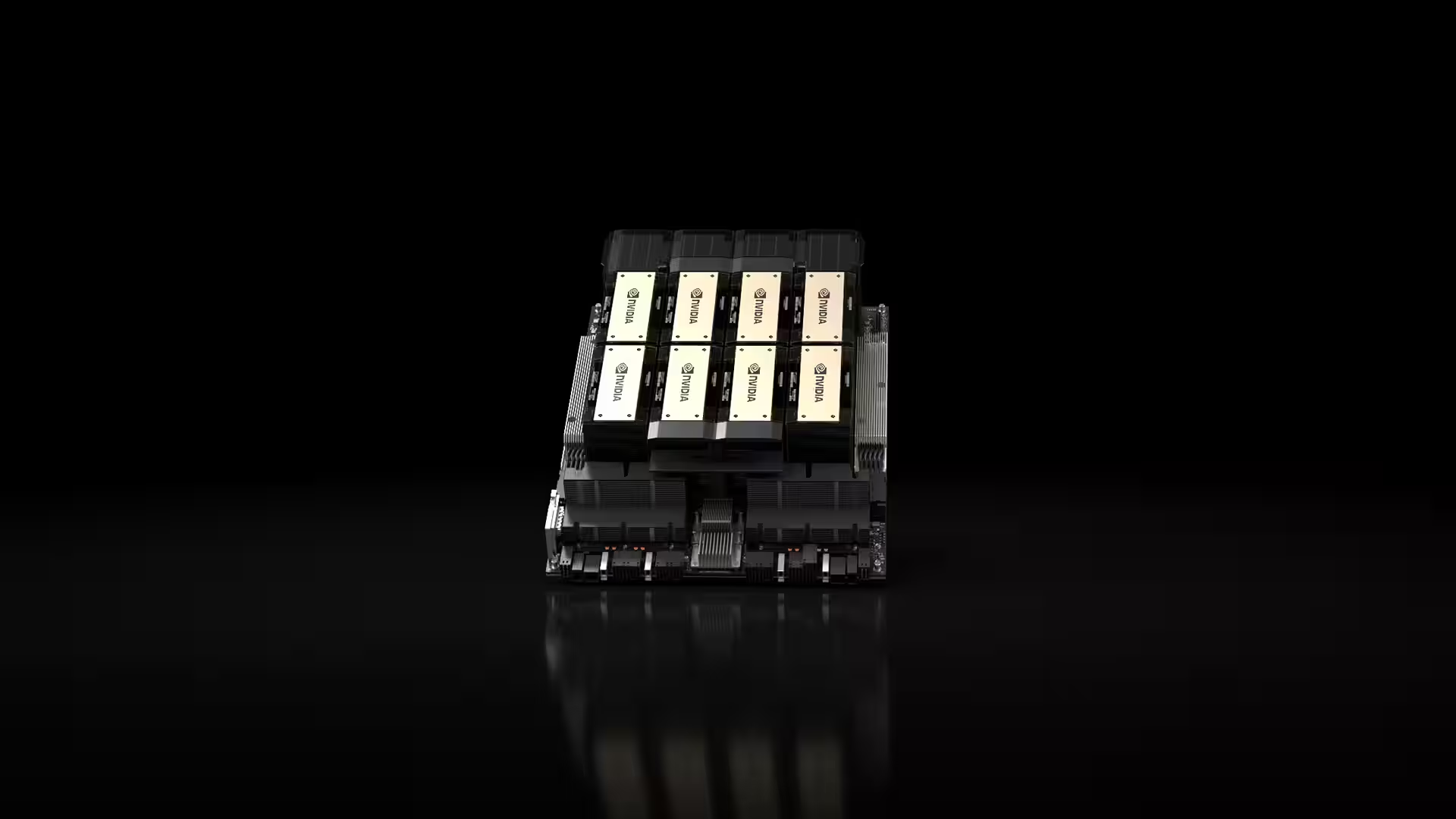

New generation of chips and national strategy

In September, state media reported that Alibaba’s new processor is comparable in performance to Nvidia’s H20 but consumes less power. Huawei also unveiled its own chips and a three-year strategy to push Nvidia out of the AI market.

Huawei has also unveiled its own chips and a three-year strategy to push Nvidia out of the AI market.

MetaX supplies solutions to state-owned companies like China Unicom, and Cambricon Technologies shares have doubled in the past three months amid expectations of growing local manufacturing.

«The competition is already here» — an Nvidia spokesman said, commenting on China’s success. The company emphasized that it will continue to fight for the trust of developers around the world.

The company said it will continue to fight for the trust of developers around the world.

Leading and Lagging

According to experts, Chinese chips are already comparable to U.S. chips in predictive AI tasks, but are inferior in analytics and complex computing. «The gap is narrowing, but catching up with the U.S. is unlikely to happen any time soon», — notes computing expert Jawad Hajj-Yahya.

Huang, for his part, recognizes the strengths of the Chinese market —s huge talent pool, high competition and rapid progress. He urged the U.S. to «fight for survival».

China’s systemic weaknesses remain, however: a state focus on single goals can stifle innovation, and the user experience still lags behind Nvidia’s standards.

Trade leverage and the prospect of independence

According to experts, Beijing’s high-profile claims of breakthroughs in chip-making also serve as «a negotiating tool» in its trade war with the United States. China is demonstrating strength while continuing to buy U.S. technology.

«Washington has hit precisely at China’s most vulnerable spot —dependence on advanced U.S. chips» — says engineer Raghavendra Anjanappa.

But he also notes: at the current pace, China could achieve technological independence from the U.S. in as little as five years.